Last Updated on September 19, 2025 by Patrick Camuso, CPA

The digital asset economy is entering an era of regulatory change and enforcement . The IRS has begun issuing 1099-DA forms and global regulators are expanding their frameworks. Investors, founders, and merchants can no longer rely on fragmented reporting or generalist accounting firms.

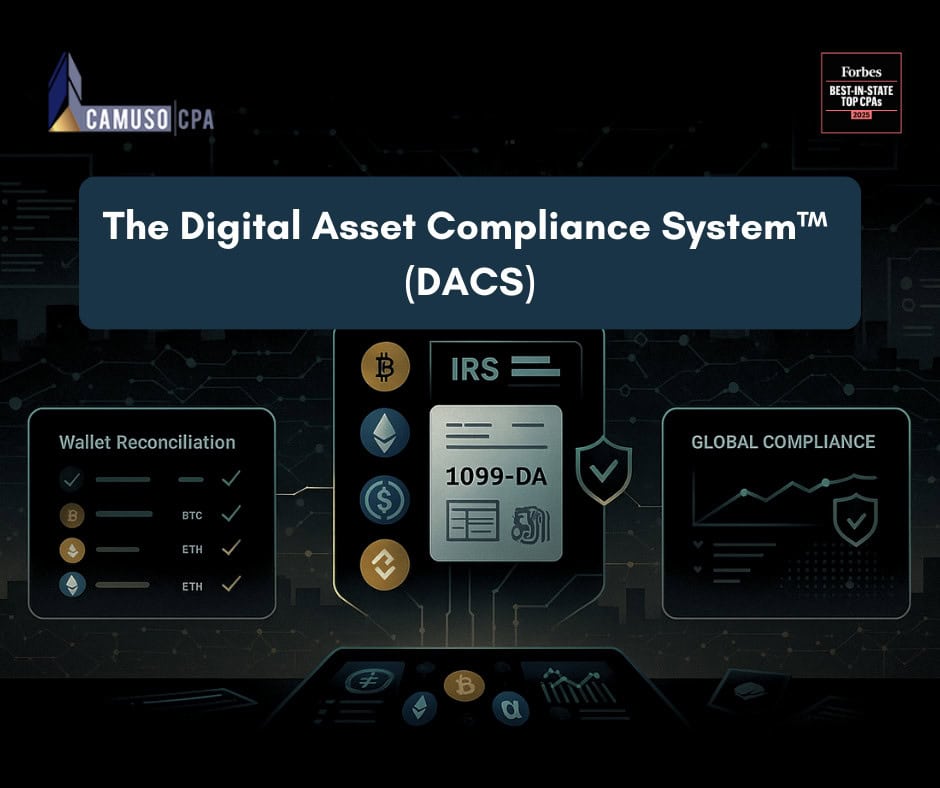

At Camuso CPA, we have spent nearly a decade engineering systems designed specifically for digital assets. Recognized by Forbes as a 2025 Best-in-State Top CPA, we are proud to introduce the the Digital Asset Compliance System™ (DACS), an AI-enabled, crypto-native framework for digital asset tax, accounting, and compliance.

Why Frameworks Matter

Every established industry is built on codified methodologies.

The digital asset economy deserves the same rigor for crypto taxes and accounting. Investors need documented, repeatable systems that withstand audits, scale with complexity, and protect wealth. The Digital Asset Compliance System™ (DACS) was created to meet that need.

The Digital Asset Compliance System™ (DACS) is the umbrella framework . Within it, we deploy proprietary frameworks that address critical dimensions of digital asset compliance.

The Digital Asset Compliance System™ (DACS) is the culmination of more than a decade of crypto-native tax and accounting specialization, recognition as a Forbes Best-in-State CPA firm, and the development of proprietary, trademarked frameworks designed for IRS and state enforcement. Unlike software tools that produce incomplete exports, ChainRecon™ reconstructs and validates data with evidence. Unlike generalist firms, Camuso CPA has been crypto-native since 2016, with deep specialization across reconciliation, planning, and compliance. And unlike competitors who rely on ad hoc tax advice, the Digital Asset Compliance System™ operates through documented, codified systems supported by rigorous quality controls. These distinctions make it the only framework engineered for digital-asset enforcement readiness.

Who the Digital Asset Compliance System™ (DACS) Serves

- High-net-worth investors requiring reconciliation, portfolio planning, and estate integration

- Web3 founders needing institutional-grade accounting and reporting

- Merchants and e-commerce operators managing crypto transactions at scale

ChainRecon™

Proprietary Accounting & Reconciliation Methodology

ChainRecon™ is the foundation of the The Digital Asset Compliance System™ (DACS). It is a proprietary accounting process, far more than a software export, that solves the systemic failures of crypto tax platforms and generic reconciliation tools.

ChainRecon™ ensures data integrity, accuracy, and audit defensibility by:

- Normalizing data, confirming data completness and ensuring accurate tax classification

- Reconciling across exchanges, wallets, and DeFi protocols

- Capturing missing transactions from broken APIs and incomplete records

- Mapping wallet ownership and resolving cross-wallet continuity

- Documenting complex on-chain events such as staking, bridging, wrapping, and token migrations for tax purposes

- Producing a complete evidence pack of workpapers, tie-outs, and variance analyses

Case Study: Using ChainRecon™, we reconstructed more than 100,000 transactions spanning multiple tax years, chains, centralized platforms, and wallets for an eight figure investment portfolio. The result was an investor-grade ledger that withstood institutional due diligence and regulatory review.

Digital Asset Tax Blueprint™

Proprietary Cryptocurrency Portfolio Tax Planning Process

The Digital Asset Tax Blueprint™ is Camuso CPA’s holistic planning framework for high-net-worth investors and founders. It integrates the entire portfolio and tax picture into a coherent, defensible wealth and compliance strategy that is integrated with your on-chain acconting system.

The Blueprint addresses all critical dimensions of advanced tax planning, including:

- Capital Gains Optimization: Timing strategies, harvesting methodologies, and character conversion.

- Portfolio & Asset Integration: Consolidated planning across digital assets, fiat, equities, real estate, and alternative investments.

- Entity Structuring: Multi-entity domestic and international planning (LLCs, C-Corps, partnerships, trusts, and offshore vehicles).

- Cross-Border Planning: Coordination with foreign tax regimes and treaty jurisdictions for globally mobile founders and investors.

- Wealth & Estate Planning: Trust structures, succession planning, and integration of digital assets into broader estate frameworks.

- Audit Readiness: Standardized methodologies, documentation, and defensible workpapers.

- Risk Management: Monitoring exposure to regulatory change and market volatility.

Case example: By applying the Digital Asset Tax Blueprint™, we reduced a founder’s effective capital gains exposure by over $1 million while simultaneously implementing a trust structure that safeguarded more than $25 million in estate assets.

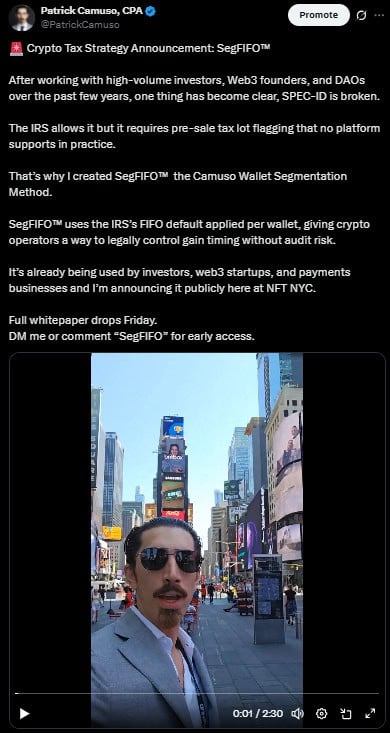

SegFIFO™

Proprietary Crypto Cost-Basis and Wallet Architecture Strategy Aligned with Rev. Proc. 2024-28

SegFIFO™ is a proprietary technical framework embedded within the Digital Asset Tax Blueprint™. It provides the cost-basis integrity, wallet architecture, and flow-of-funds clarity aligned with Rev. Proc. 2024-28 that makes the Blueprint optmized and audit-ready.

SegFIFO™ emphasizes:

- Wallet Architecture: Purpose-built segregation of wallets for strategy and compliance that is aligned with Rev. Proc. 2024-28.

- Flow-of-Funds Mapping: Categorizing and tracing movement across wallets and platforms that is aligned with Rev. Proc. 2024-28

- Timing Control: Enabling strategic realization of gains and losses by isolating lots for harvesting or deferral that is aligned with Rev. Proc. 2024-28

- Audit Defensibility: Cleaner accounting, stronger workpapers, and transparent reporting trails.

Case example: Through SegFIFO™, we re-architected a client’s wallet structure to segregate tax lot tranches and holding periods. This created clarity into capital gains timing, enabled targeted harvesting strategies, and prevented over $150,000 in misclassified gains from exchange-level FIFO reports.

SegFIFO™ was first unveiled publicly in Times Square during NFT NYC in 2025, where Camuso CPA presented the methodology as part of our leadership in setting the standard for digital asset accounting.

Integration: Blueprint + SegFIFO™

The Digital Asset Tax Blueprint™ provides the strategic architecture including multi-entity planning, estate integration, and holistic portfolio design.

SegFIFO™ provides the technical mechanism for portfolio optmization and management including cost-basis continuity, wallet architecture, and timing control.

Together, they deliver:

- A long-term strategy that integrates tax, wealth, and estate planning across the entire tax picture and cryptocurerncy portfolio.

- Precision accounting that makes the strategy enforceable.

Clarity and flexibility that generic software or ad-hoc tax planning methods cannot replicate.Crypto Compliance Guard™

Quarterly Compliance Framework

The Digital Asset Compliance System™ (DACS) is not a one-time process. Compliance requires continuous monitoring. Crypto Compliance Guard™ is our quarterly system for proactively surfacing and resolving regulatory risks and tax optimization opportunites before they become penalties or afterthoughts.

It integrates reconciliation reviews, tax adjustments, and jurisdictional compliance checks into a repeatable quarterly cadence.

Case example: Through Crypto Compliance Guard™, a founder avoided more than $40,000 in late filing penalties across multiple states.

Crypto Merchant Compliance™

Comprehensive Accounting and Tax Framework for On-Chain Commerce

Up until this point, the Digital Asset Compliance System™ (DACS) has focused primarily on investors and founders. But the next wave of adoption is unfolding in on-chain commerce and merchant adoption including NFT platforms, Web3 merchants, and e-commerce operators transacting directly in digital assets. To meet this demand, Camuso CPA has launched a new service vertical dedicated to this category.

On-chain commerce introduces complexities that extend far beyond traditional accounting. Web3 merchants, NFT platforms, decentralized commerce operators along with eCommerce stores and other merchants adopting stablecoins must address accounting system design, real-time transaction reconciliation, multi-jurisdictional compliance, on-chain sales tax and integrated tax planning, all in an environment where existing tools are inadequate.

Crypto Merchant Compliance™ is our end-to-end service offering for on-chain commerce accounting and taxation, delivering:

- Integrated Accounting System Architecture: Design and implementation of sub-ledgers, reporting flows, and controls specific to crypto commerce.

- Ongoing Maintenance: Continuous reconciliation, exception handling, and data integrity checks for digital asset transactions.

- Integrated Tax Planning: Alignment of on-chain activity with federal, state, and international obligations, including entity structuring and optimization.

- Sales Tax Strategy and Execution: Nexus detection, jurisdictional filings, and ongoing compliance, supported by our published expertise on NFT sales tax.

- Audit Readiness: Documentation and evidence trails designed to withstand scrutiny from regulators and auditors.

Camuso CPA is uniquely positioned in this space. Our founder authored the first comprehensive book on NFT sales taxes and has established a national reputation as a thought leader in on-chain commerce compliance.

Case example: For a Web3 merchant processing thousands of transactions monthly, Crypto Merchant Compliance™ delivered a custom accounting system, continuous reconciliation protocols, a quarterly compliance cadence, and a multi-state tax planning strategy that eliminated exposure and enabled investor-grade reporting.

By combining on-chain accounting infrastructure design, ongoing compliance execution, and strategic tax planning, Crypto Merchant Compliance™ establishes Camuso CPA as the premier firm for digital asset commerce.

Future-Proofing Compliance

The Digital Asset Compliance System™ (DACS), is continuously refined as the IRS, state and global regulators expand their digital-asset frameworks. Clients benefit from ongoing updates, periodic audits, and enhancements, ensuring they remain ahead of regulatory and enforcement developments.

Wrapping Up

The digital asset economy is maturing, and regulatory enforcement is accelerating. Sustainable success will not depend on one-off tax filings or blind reliance on softwares but on adopting documented, defensible systems.

The Digital Asset Compliance System™ (DACS), provides that system. It is AI-enabled, crypto-native and audit-ready.

Camuso CPA is proud to lead this transformation.

Next Steps

- Schedule a private strategy consultation

- Subscribe to the Digital Asset Digest for compliance and enforcement updates

Download our complimentary Crypto Tax Blueprint™, adapted from the Digital Asset Tax Blueprint™ process

Frequently Asked Questions

What is the Digital Asset Compliance System™ (DACS)™?

The Digital Asset Compliance System™ (DACS) is our proprietary, AI-Native, CryptoNative framework for digital asset compliance.

What is ChainRecon™?

ChainRecon™ is our proprietary accounting and reconciliation methodology. It goes beyond crypto tax software by addressing data integrity and reporting failures, producing complete, audit-ready reconciliations across wallets, exchanges, and on-chain activity.

What is the Digital Asset Tax Blueprint™?

The Digital Asset Tax Blueprint™ is our portfolio planning framework for high-net-worth investors. It integrates tax, estate, entity, and cross-border planning into a holistic wealth architecture.

What is SegFIFO™ and how does it fit into the Digital Asset Compliance System™ (DACS)?

SegFIFO™ is our proprietary cost-basis and wallet architecture strategy. It is embedded within the Digital Asset Tax Blueprint™ and ensures continuity, clarity, and timing control of capital gains events.

What is Crypto Merchant Compliance™?

Crypto Merchant Compliance™ is our end-to-end accounting and tax framework for on-chain commerce. It covers accounting system design, reconciliation, maintenance, integrated tax planning, and sales tax compliance.

How does this differ from crypto tax software?

Software aggregates transactions but often misses data, misclassifies activity, and breaks cost-basis continuity. Sofware also doesn’t optmize your portfolio and entire tax picture for tax purposes or prepare you for audits. The Digital Asset Compliance System™ (DACS) applies proprietary methodologies (ChainRecon™, Digital Asset Tax Blueprint™, SegFIFO™, Crypto Compliance Guard™, and Crypto Merchant Compliance™) alongside CPA oversight to deliver accurate, audit-ready results.