-

You are leaving money of the table by neglecting tax planning. Whether you have an individual cryptocurrency portfolio or digital business you may be leaving thousands, possibly millions on the table in overlooked tax savings. Building a tax plan is foundational to any serious wealth strategy.Whether you have unrealized or realized cryptocurrency capital gains or have a large amount of income from a successful digital business, Camuso CPA will help you establish the right tax planning structure to legally minimize your taxes and protect your assets. We take the sophisticated tax planning and asset protection tools that are used by the wealthy and large corporations and make them accessible to crypto investors and digital business owners.

We’ll go over our approach to tax planning for cryptocurrency investors and digital businesses by outlining many of the common strategies we use with cryptocurrency investors and digital businesses.

-

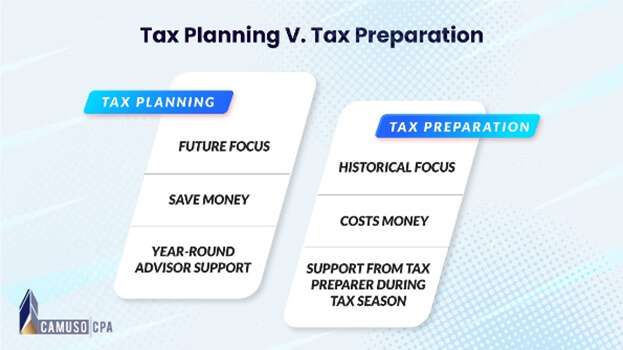

Most people believe that when they get their taxes completed, their CPA has helped them organize their life to pay as little taxes as possible. But that’s not true. There is a huge difference between tax preparation and tax planning.

When you get your tax return prepared, your CPA is focused on accurately and timely fling your tax return based on your historical information. Tax planning is a process designed to protect your assets and minimize your taxes for future and current tax years.

The key to minimizing taxes is planning in advance. If you wait until you file your tax return to consider your taxes, it is likely too late to utilize many powerful tax planning opportunities available to you. That’s why we tax plan.

-

Tax planning well in advance of any potential tax liabilities is key to legally minimizing your tax liabilities and protecting your assets. To properly design and implement your tax plan, accounting and tax preparation are still important aspects of managing your wealth and business.

Our tax planning process starts with your current financial position then projects different scenarios into the future based on your facts and circumstances. That means your cryptocurrency accounting and company accounting need to be up to date so we have a clear understanding of your current financial situation. Even the best tax plans will not yield tax savings without accurate, timely tax filings. This requires accurate and timely tax preparation each year.

The good news that in addition to tax planning services for cryptocurrency investors and digital businesses, Camuso CPA offers tax preparation, cryptocurrency accounting and traditional accounting services to mange this full process.

-

It’s key to take a holistic approach to your tax plan. This means that you need to consider tax planning for each company that you own along with your personal taxes. When considering your personal taxes, you need to consider your cryptocurrency portfolio along with any other investment portfolios, assets and income.

Any time you’re reviewing your tax plan, be sure to consider your company and your full personal tax situation together to ensure you are maximizing your net tax liabilities.

-

Unfortunately, cryptocurrency investors and digital business owners almost never receive adequate tax advice or planning from their CPAs on how to reduce their tax bills. We review hundreds of new tax returns each year and over 90% of them have errors or missed opportunities that cost taxpayers thousands and sometimes millions of dollars. To worsen this issue, most CPAs do not even have a proper understanding of cryptocurrency transactions to adequately interpret tax code sections realted to your portfolio or business.

Believe it or not, many CPA’s don’t even offer tax planning services since they just focus on filing tax returns each year. Many CPAs will just prepare your return each tax year and answer a few questions during your review with them. What many CPAs do not offer is a structured tax planning process that assesses and addresses your fundamental tax planning needs with a systematic method.

-

We save digital businesses thousands, sometimes millions with proactive tax planning. The tax code favors business owners. The key is planning in advance of tax filings with a structured process that ensures your business is legally minimizing their taxes as much as possible.

Digital business owners should focus on the following areas related to the tax code and their business:

Legal Entity Structure

Depending on your facts and circumstances your business may be structured as an S-Corporation, C-Corporation or Partnership for tax purposes. To determine the best tax structure for your digital business our tax planning process includes detailed scenario-based tax projections and reasonable compensation studies. These are used to determine the best tax structure for your business by estimating the net tax implications of each structure.

In a business where substantial profits are being reinvested into the business rather than being distributed to owners, a C-Corporation structure may be more beneficial. In a business where substantial profits are being distributed to owners rather than being invested into the business a S-Corporation structure may be more beneficial.

It’s important to properly manage the tax structure you establish for your business to legally minimize your taxes. This includes meeting all tax reporting requirements, reasonable compensation requirements and managing your funds appropriately.

Capital Management

If you’re business is receiving cryptocurrency as a form or payment for business services, product sales, mining rewards, NFT sales or other types of crypto transactions it is important to properly manage your funds to avoid overpaying in taxes. This means managing your capital for estimated tax payments and avoiding commingling funds.

To avoid commingling business funds, you must establish separate business accounts for your company and only use these accounts for business purposes rather than personal accounts. This includes banks and credit cards. This also includes cryptocurrency exchanges, NFT exchanges and decentralized wallets. You should establish exchange accounts under your EIN rather than SSN and establish dedicated wallets associated with your company transactions rather than personal.

It is important to consider you tax liabilities monthly or quarterly to avoid receiving BTC, ETH or another cryptocurrency at a high valuation when you are taxed on receipt only to then have it drop significantly in price in the same tax year before you liquidate the crypto to pay your tax liability.

This can lead to you having to liquidate a large amount of BTC, ETH or other assets at a low valuation to cover your tax liabilities when you pay your taxes for when you received the asset at a high valuation. Best practice is to liquidate at least your tax liability into USD or USDC to ensure you cover your taxes regardless of market conditions.

Tax deductions and credits

If you follow the rules, you should enjoy legal tax deductions and be well-prepared for an audit. Understanding exactly what you need to do to legally claim your deductions means that even if you are audited, you have followed the rules and minimized the likelihood of having any audit adjustments.

The IRS code has dozens of deductions and credits that are available for expenses incurred that are ordinary and necessary to your digital business. This can include deductions like the Augusta deduction, home office, accountable reimbursements, GAS fees related to cryptocurrency transactions, accelerated depreciation for cryptocurrency mining equipment, tax credits and much more.

Retirement Planning and Insurance Planning

Optimizing your retirement accounts and insurance deductibility for your company is an important aspect to legally minimize your taxes. Ensuring you are in the right vehicles

This can mean using one or a combination of the following types of retirement vehicles.

Self-Directed

A self-directed retirement account allows the investor to be responsible for all the investment decisions. The self-directed IRA provides the investor with greater opportunity for asset diversification outside of the traditional stocks, bonds, and mutual funds. Self-directed IRAs can invest in cryptocurrency, NFTs, real estate, private market securities and more.

ROTH 401(k)

A Roth 401(k) is an employer-sponsored investment savings account that is funded with post-tax money up to the plan’s contribution limit.

Traditional 401(k)

A Traditional 401(k) is a qualified employer-sponsored retirement plan that eligible employees may make salary-deferral contributions to on a post-tax and pretax basis. Employers offering a 401(k) plan may make matching or non-elective contributions to the plan on behalf of eligible employees and may also add a profit-sharing feature to the plan.

Defined Benefit Plans

A defined benefit pension plan allows the employer to promise a specified pension payment upon retirement that is predetermined by a formula based on the employee’s earnings history, tenure of service and age, rather than depending directly on individual investment returns.

Cash Balance Plans

A cash balance pension plan allows the employer to credit a participant’s account with a set percentage of his or her yearly compensation plus interest charges.

Regulatory changes

Tax regulations are always changing. This is especially true for the rapidly developing cryptocurrency and digital asset sector. It’s important to consider current and future regulatory changes during your tax planning process because this can significantly impact your strategies that you implement into your business.

This means considering existing regulatory changes such as current crypto tax guidance, tax law changes including the CAREs ACT and proposed bills such as the Responsible Financial Innovation Act. These types of regulatory changes can impact entity structuring decisions, tax implications to certain cryptocurrency transactions and other relevant considerations that are vital to address as part of your planning.

Niche specific and Advanced strategies

When your business is receiving or purchasing cryptocurrency or NFTs there are many specific considerations depending on the nature of your transactions that should be considered in detail as part of your tax plan. To learn more, check out our Definitive Tax Guide to Cryptocurrency.

-

Borrowing Cryptocurrency

When you need access to liquidity and have cryptocurrency with large unrealized capital gains, borrowing against your crypto assets may be a viable strategy. In most cases, if you borrow against your cryptocurrency assets, this will not trigger a taxable event and will allow you to defer your capital gains into the future when you sell your assets.

When borrowing cryptocurrency there are important considerations to ensure you don’t trigger taxable events. It is important to understand that you cannot sell or exchange the collateral that you put up. On some platforms you can put up one cryptocurrency as collateral but then receive back a different cryptocurrency. This is a taxable event and should be avoided if tax deferral is your goal.

Borrowing cryptocurrency does not come without risks which include volatility and counterparty risk. This means that you need to consider how much leverage to use to be sure to avoid a forced sale if the price of your underlying cryptocurrency asset drops significantly. You also must consider the counterparty that is holding your cryptocurrency as collateral for the loan and risks associated with the solvency of the company or protocol.

Gifting Cryptocurrency

The annual gift tax exclusion is $16,000 for the 2022 tax year. This amount can be gifted without those gifts counting against the $12.06 million lifetime exemption. After exceeding the $15,000, there is a $12.06 million federal estate tax exemption for 2022. You can leave up to that amount to relatives or friends free of any federal estate tax. Gifts more than the annual exclusion will reduce your estate tax exemption. If you make a taxable gift, you must file Gift Tax Return.

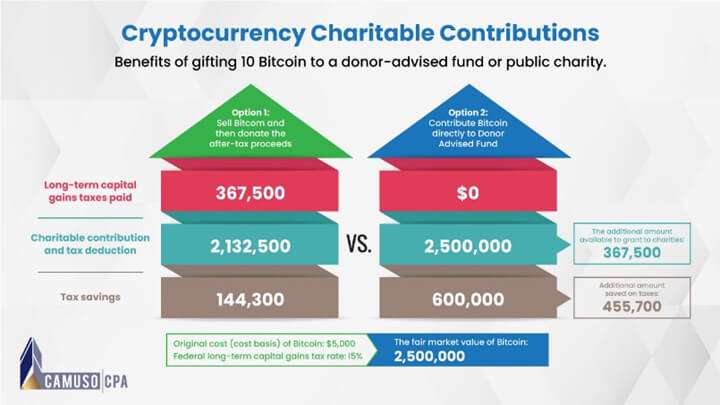

Donating Cryptocurrency

You can donate cryptocurrency to charities that accept cryptocurrencies. As long as you donate the cryptocurrency directly to the charity you will not be taxed when donating the cryptocurrency. You must donate directly to the charity, as selling it first would be taxableAdditionally, depending on how long your held the cryptocurrency you are eligible for a charitable deduction as an itemized tax deduction.

if you held your cryptocurrency for one year or less then you can deduct the lesser of your basis in the cryptocurrency or its fair market value up to 50% of your annual gross income. If the asset was held as an investment for more than one year and you itemize deductions, you may deduct the fair market value which is determined by a qualified appraisal of the gift, up to 30% of your adjusted gross income.

To substantiate your charitable income tax deduction, you are required to complete Form 8283 and obtain a qualified appraisal from a qualified appraiser for contributions of cryptocurrency valued at more than $5,000.

Once you’ve identified a charity, you’ll need to make sure it is a qualified charitable organization under the IRS. Qualified organizations must meet specific requirements as well as IRS criteria and are often referred to as 501(c)(3) organizations.

Donor-advised funds, which are 501(c)(3) public charities, can be a tax-efficient solution for accepting contributions of cryptocurrency, as the funds typically have the resources and expertise for evaluating, receiving, processing, and liquidating non-cash assets.

Wash Sales & Lost Harvesting

Since cryptocurrencies are generally classified as property, wash sale regulations should not currently be a concern for investors. This means investors can sell an investment to realize a tax loss, only to buy it back to maintain their market position in the crypto asset. Today, wash sales only apply to stocks and securities, but this may change in the future as there is political pressure to apply wash sale regulations to cryptocurrency.

It is important to also ensure that your crypto transactions that have losses have economic substance. You should not sell positins simply because you want a loss but in consideration of market conditions that with digital assets can change by the minute, hour and day.

It’s important to keep your crypto accounting accurate and up to date on a monthly or quarterly basis. This will enable you to monitor your cost basis along with the market to take advantage of any wash sales or loss harvesting opportunities as they appear based on market conditions.

Trusts for Cryptocurrency

Depending on your facts and circumstances your portfolio and business may benefit from various types of trust structures that can protect your assets, plan for retirement and in many cases defer taxes.

To determine the best tax structure for your digital asset portfolio and business our tax planning process includes detailed scenario-based tax projections. These are used to determine the best tax structure for your business by estimating the net tax implications of each structure.

Qualified Opportunity Zones for Cryptocurrency

Investing in an opportunity zone fund is another option for deferring and reducing your capital gains associated with the sale of cryptocurrency or NFTs. The capital gains from the sale will have to be reinvested into an Opportunity Zone Fund within 180 days after the sale. If the capital gains are reinvested the taxes due are deferred until the earlier of the date on which the opportunity zone investment is sold or exchanged or Dec. 31, 2026.

Up to 15% of the deferred gain is permanently excluded from income if the opportunity zone investment is held for more than seven years. Additionally, any post-investment appreciation in the QOF is permanently excluded from income if the investment is held at least 10 years.

What Does Our Tax Plan include?

Tax Planning for digital businesses transacting in cryptocurrency is a structured process designed to protect your assets and minimize your taxes which focuses on:

- Legal Entity Structure

- Capital Management

- Tax deductions

- Retirement Planning

- Insurance Planning

- Regulatory change

- Estate & Trust Planning

- Niche specific strategies

- Advanced planning strategies

During this process we complete three consultations, scenario-based tax projections, a comprehensive tax planning report, two reasonable compensation studies and offer ongoing support after the initial planning process to ensure you legally minimize your taxes and protect your assets.

We have experience serving the sophisticated and expanding needs of a wide range of institutional, corporate, high-net worth and individual clients that are digital asset investors and digital business owners including:

- Cryptocurrency, DeFi & NFT Investors

- High Net Worth Individuals

- Crypto Mining Operations

- Corporations with Crypto Transactions

- NFT Artists & Dealers

- Consultants and Advisors

- eCommerce Businesses

- Executives compensated with crypto and/or RTUs

- Web 3.0 Start Ups

- Crypto Gaming

- VC & PE Firms

-

Tax planning is a key step to wealth building. Taxes are usually the largest yearly expense for most crypto investors and most digital business owners.

At Camuso CPA, we have established a well-tested process to deliver clients with crypto assets and digital businesses sophisticated tax planning that allows them to legally minimize their taxes and protect their assets.

If you have realized or unrealized cryptocurrency capital gains or income from a digital business Camuso CPA will help you establish the right tax planning structure to meet your needs.

-

Camuso CPA saves you money, time and peace of mind.

We save digital asset investors and digital businesses thousands and cumulatively millions with effective tax planning strategies, accurate accounting and proactive advice.

At Camuso CPA, all our clients are digital asset investors and digital business owners. We’ve developed cryptocurrency specific expertise that allows us to provide tailored solutions to our clients in ways most other firm simply can’t.

Camuso CPA was one of the first CPA firms in the industry to provide their clients cryptocurrency accounting services and tax advisory. Camuso CPA was also the first CPA firms to accept cryptocurrency as a form of payment for professional services.

Learn more about us here.

-

- Schedule a time to speak with our team in detail about your taxes and accounting

- Read our Definitive Guide for Cryptocurrency Taxation to learn about cryptocurrency taxes from an experienced CPA.

What client's have to say

Reach out to connect and learn more about us

Industry Leading Tax, Accounting & Financial Advice

Work With Us Loading...

Loading...