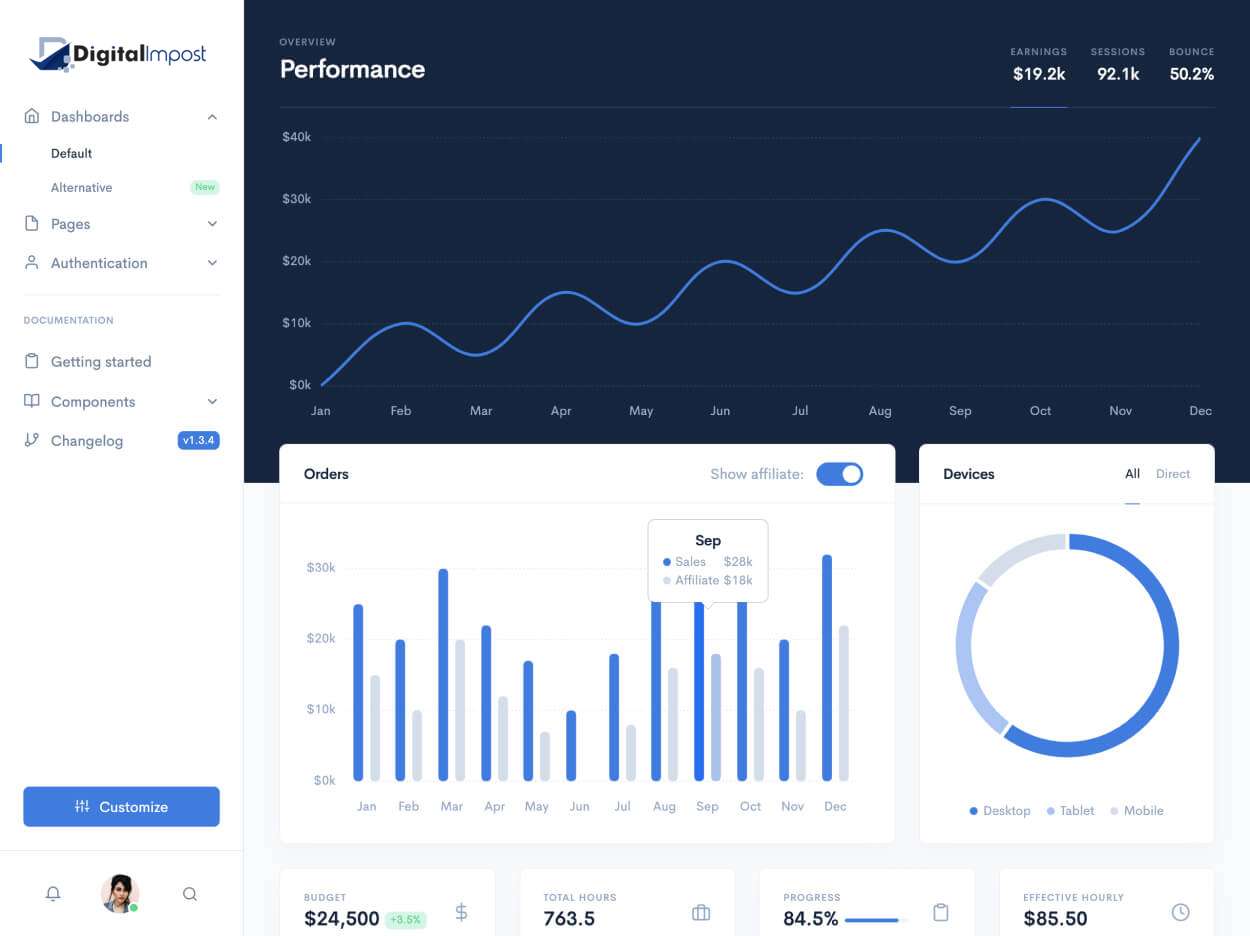

Accurately calculate roof-top accurate sales tax rates at scale in native cryptocurrencies to ensure sales tax compliance across tax jurisdictions and for a seamless customer experience.

Many CPAs are not aware or up to date on sales tax regulations related to NFTs, digital assets . This creates a large compliance risk for Web3 businesses.

Our team at Camuso CPA is on top of a rapidly developing NFT sales tax landscape.

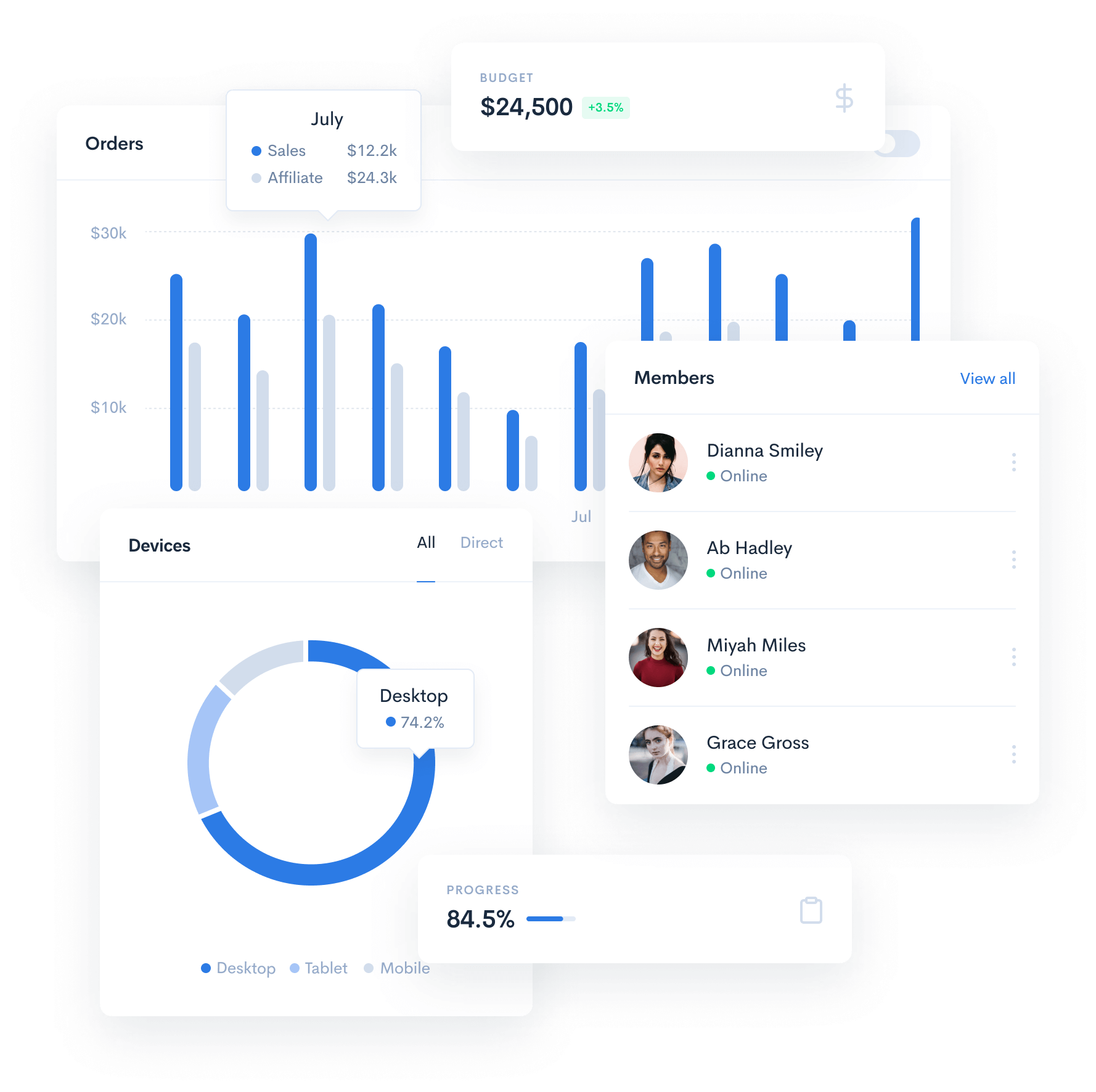

We leverage extensive tax experience, the latest technologies and work specifically with Web3 businesses to ensure we do not make critical tax errors that cost you money.

Each tax return we prepare goes through structured review process to ensure everything is filed accurately, timely and you're not subject to penalites, interests or business disruptions.

Work with an experienced digital asset CPA firm that understands NFT sales tax

When it comes to fling taxes, accuracy and timeliness is what counts. When you work with Camuso CPA you get your returns filed accurately and timely with an experienced and trusted cryptocurrency CPA.

Here's how the process goes

During the initial onboarding process you will have a consultation with your tax manager to discuss the tax preparation process, your tax needs, engagement expectations and what information we will need to prepare your return before you complete the onboarding process to provide your information and tax documentation.

Our team will assess your business, sales history and sales projections to evaluate your compliance needs for recommendations and a compliance roadmap.

Our team will manage your tax filings across tax jurisdictions for both back taxes and ongoing tax obligations.

We help Web3 Businesses and NFT artists with the following sales tax issues:

- Your Tax Returns Are Getting Too Complicated

- You Do Not Understand Your NFT and Digital Asset Sales Tax Obligations

- You Have Sales Tax Compliance Issues

- Your current CPA's processes and workflows are outdated

- Your CPA doesn't file your tax returns accurately or on time and it's impacting your bottom line

What client's have to say

Reach out to connect and learn more about us

Industry Leading Tax, Accounting & Financial Advice

Work With Us Loading...

Loading...