Last Updated on September 25, 2025 by Patrick Camuso, CPA

Why Cryptocurrency Tax Return Is not Like Anything Else

Filing your cryptocurrency tax return isn’t like reporting stocks or mutual funds. The IRS treats digital assets as property, not currency, which means every move you make can create a taxable event. Selling, swapping, or even spending your Bitcoin at checkout could all generate capital gains or losses. That complexity is why so many investors get tripped up at tax time.

At Camuso CPA, we’ve seen firsthand how even a small reporting error can snowball into penalties or IRS inquiries. That’s why professional guidance matters, especially for high-net-worth investors with multi-exchange, multi-wallet activity.

Key Takeaways

- The Internal Revenue Service (IRS) treats crypto as property. Every taxable event can trigger capital gains tax.

- Accurate reporting prevents costly mistakes like audits or penalties.

- Crypto tax rules are evolving quickly with new IRS reporting forms.

- Specialized expertise is often necessary to stay compliant.

- A CPA with crypto tax experience can reduce errors, optimize deductions, and defend your return.

It’s Going Mainstream, and the IRS Knows It

Crypto isn’t a fringe investment anymore. Bitcoin, Ethereum, and stablecoins are embedded in mainstream finance. In response, the IRS has dramatically expanded enforcement. One example: when the agency took Coinbase to court to access customer records, it signaled a new era of digital asset oversight.

Patrick Camuso, CPA “Every crypto transaction leaves a digital footprint. The IRS can follow it across exchanges, and their tools are only getting more sophisticated.”

The message is clear: underreporting is no longer an option.

How Cryptocurrency Is Taxed

The IRS applies capital gains tax to most crypto transactions. When you sell, trade, or spend coins, your taxable gain or loss depends on the gap between your cost basis and the fair market value at the time.

Short-term gains (held for one year or less) are taxed as ordinary income.

Long-term gains (held for more than one year) benefit from lower tax rates.

Ordinary income tax also applies to activities like mining, staking, or airdrops. For example, if you mined ETH worth $5,000 at receipt, that’s taxable income. Later sales trigger capital gains tax as well.

Example: Buy 1 BTC at $20,000 → Sell at $35,000 → Report $15,000 in taxable gains.

For many investors, these rules sound simple on paper but become confusing in practice. A single coin can move through wallets, swaps, and DeFi protocols before you ever sell it. Each step changes your tax picture. That’s why so many people are surprised by their tax bill, and why working with a professional who understands crypto makes the difference between clarity and costly mistakes.

Why DIY Cryptocurrency Tax Returns Are Risky

Even savvy investors struggle with crypto taxes. Calculating cost basis across multiple wallets, exchanges, and transaction types is rarely straightforward. Every crypto-to-crypto trade is taxable. Add NFTs, DeFi income, or staking rewards, and things get even more complex.

IRS enforcement data shows reporting errors on digital assets have grown by more than 50% in just three years. That trend underscores the risks of trying to prepare your own return without specialized knowledge.

We’ve seen what happens when smart, successful people try to manage crypto taxes on their own. They don’t cut corners, they simply don’t realize how easy it is to miss something. A token swap here, a forgotten airdrop there, and suddenly the IRS sees underreporting. Having a crypto-focused CPA isn’t just about filing correctly—it’s about protecting yourself from costly mistakes you never knew you were making.

Professional Expertise Matters

Not every CPA is fluent in crypto tax law. The right advisor should:

- Follow the latest IRS guidance on digital assets.

- Handle complex portfolios with confidence.

- Advise on tax-loss harvesting, crypto donations, and entity structures.

IRS Notice 2014-21 requires taxpayers to keep detailed records: dates, amounts, wallet addresses, fair market value, and cost basis. A qualified CPA can make sure those details translate into accurate, defensible filings.

At Camuso CPA, we specialize in crypto tax planning and reporting. Our proprietary strategies, including SegFIFO™ and Crypto Merchant Compliance™, are designed to optimize outcomes while staying compliant.

Avoiding Audits and Court

Even a small mistake can trigger an audit. The process can mean months of stress, legal fees, and penalties. Working with a crypto-focused CPA shifts that burden. We prepare returns built to stand up to IRS scrutiny, so you can move forward with confidence.

Many of our clients come to us after trying to manage things alone. They describe sleepless nights, second-guessing every transaction, and the weight of not knowing if they filed correctly. Having a trusted advisor who understands both crypto and tax law doesn’t just protect you from audits—it gives you peace of mind. You get to focus on building your portfolio, business, or project, while we make sure the foundation is secure.

Recent IRS Updates You Need to Know

- Form 1040 now asks if you engaged in digital asset transactions.

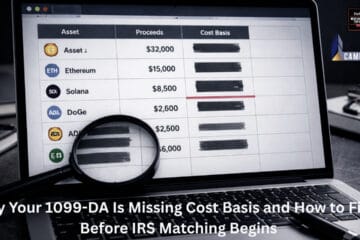

- Form 1099-DA will standardize crypto transaction reporting.

- Broker reporting rules expand in 2025, requiring exchanges to report more comprehensively.

Staying ahead of these changes is essential for accurate reporting and strategic planning.=

FAQs: Smart Strategies for Preparing Your Cryptocurrency Tax Return in 2025

1. Do I have to report every transaction on my cryptocurrency tax return?

Yes. The IRS requires you to report all taxable crypto events, including trades, sales, and spending crypto for goods or services. Even small transactions can add up, and failing to report them can trigger penalties.

2. How are NFTs, DeFi, and staking rewards taxed?

NFT sales are generally treated as capital gains. Staking rewards, mining income, and airdrops are taxed as ordinary income when received, based on fair market value at that time. Any later sales also create capital gains.

3. Can I offset crypto losses against other income?

You can use capital losses to offset capital gains, and up to $3,000 of net losses can offset ordinary income each year. Any remaining losses can be carried forward to future tax years.

4. What records should I keep for crypto taxes?

Keep detailed records of every transaction, including dates, amounts, wallet addresses, fair market value at the time, and what the transaction was for. Using a crypto-focused tax professional or specialized software helps ensure accuracy.

5. How does the IRS track cryptocurrency activity?

Exchanges issue 1099 forms, blockchain data is public, and the IRS has invested in advanced tools to trace transactions. With reporting requirements tightening in 2025, it’s riskier than ever to assume your activity won’t be noticed.

6. Are wallet-to-wallet transfers taxable?

No. Moving crypto between wallets or exchanges you own is not a taxable event. But it’s still important to track these transfers, since missing data can distort your cost basis and create errors.

7. Should I use crypto tax software or hire a CPA?

Software can help consolidate data, but it often struggles with complex transactions, DeFi, or NFTs. A crypto-focused CPA ensures accuracy, compliance, and strategic tax planning—especially if you have significant holdings.

8. What are the biggest mistakes people make on cryptocurrency tax return?

Common errors include double-counting trades, missing cost basis data, failing to report income from staking or airdrops, and assuming losses aren’t deductible. Small mistakes can flag an audit, which is why preparation matters.

9. How can I reduce my crypto tax liability in 2025?

Strategies include tax-loss harvesting, timing trades for long-term gains, using retirement accounts where eligible, and properly structuring business or mining operations. The right approach depends on your individual situation.

10. What happens if I’ve never reported crypto on past returns?

It’s better to address it proactively. The IRS offers ways to correct past filings, and working with a CPA can reduce penalties and prevent bigger problems down the road.

Schedule A Consultation Now

If you want your cryptocurrency tax return done right, accurate, compliant, and optimized, talk to the experts. Contact Camuso CPA today to schedule a consultation.

About Camuso CPA

Camuso CPA is a trusted advisor for high-net-worth crypto investors, founders, and blockchain professionals. We combine deep tax expertise with cutting-edge blockchain knowledge to deliver compliant, strategic, and profitable outcomes for digital asset holders.

By understanding your crypto tax obligations and working with experts, you can report confidently, avoid IRS scrutiny, and keep more of what you’ve earned.

Contact us today to discuss how we can support your compliance efforts and help minimize your tax liabilities.