Last Updated on April 5, 2025 by Patrick Camuso, CPA

The Internal Revenue Service (IRS) treats virtual currency as a capital asset for federal income tax purposes, meaning that transactions involving cryptocurrencies are subject to capital gains tax. This classification places virtual currency alongside stocks, bonds, and other investment assets under the internal revenue code. As a result, taxpayers must report any gains or losses realized from selling, exchanging, or otherwise disposing of virtual currency on their federal income tax returns.

To determine the taxable amount, the IRS requires taxpayers to use the fair market value of the virtual currency in U.S. dollars at the time of the transaction. This valuation is essential because the value of digital assets can fluctuate significantly. In addition to sales and exchanges, the IRS also provides guidance on more complex virtual currency transactions such as hard forks and airdrops, which can have distinct tax implications.

Given the growing popularity and regulatory scrutiny of cryptocurrencies, understanding IRS crypto tax rules is crucial for compliance. Failure to accurately report crypto transactions can result in penalties and increased tax liability. Staying informed about how the IRS views digital assets ensures taxpayers meet their obligations and avoid potential audits or fines.

Determining Taxable Income

Taxable income from virtual currency transactions encompasses more than just capital gains. It also includes ordinary income earned from activities such as mining, staking, or receiving cryptocurrency as payment for goods or services. When you receive virtual currency in exchange for work or products, the IRS considers this income taxable at its fair market value at the time of receipt.

For independent contractors paid in cryptocurrency, this income must be reported as self-employment income, subject to both income tax and self-employment tax. This classification means that the income is treated similarly to cash payments for services rendered. Therefore, virtual currency received as compensation must be included in gross income on your tax return and reported accordingly.

Accurately reporting all taxable income from virtual currency transactions is essential to comply with tax law. Whether the income arises from capital transactions or ordinary income sources, taxpayers must ensure they reflect these amounts on their tax returns to avoid penalties and underpayment issues.

Calculating Capital Gains

Capital gains from virtual currency transactions are calculated by subtracting the cost basis from the sale price. The cost basis typically includes the purchase price of the virtual currency plus any other acquisition costs, such as transaction fees. When you sell, exchange, or otherwise dispose of virtual currency, the gain or loss is determined by comparing the fair market value at the time of the transaction to your cost basis.

It is important to distinguish between short-term and long-term capital gains. Holding virtual currency for more than one year before disposing of it qualifies for long-term capital gains treatment, which generally offers lower tax rates than short-term capital gains. Short-term gains apply to assets held for one year or less and are taxed at ordinary income rates.

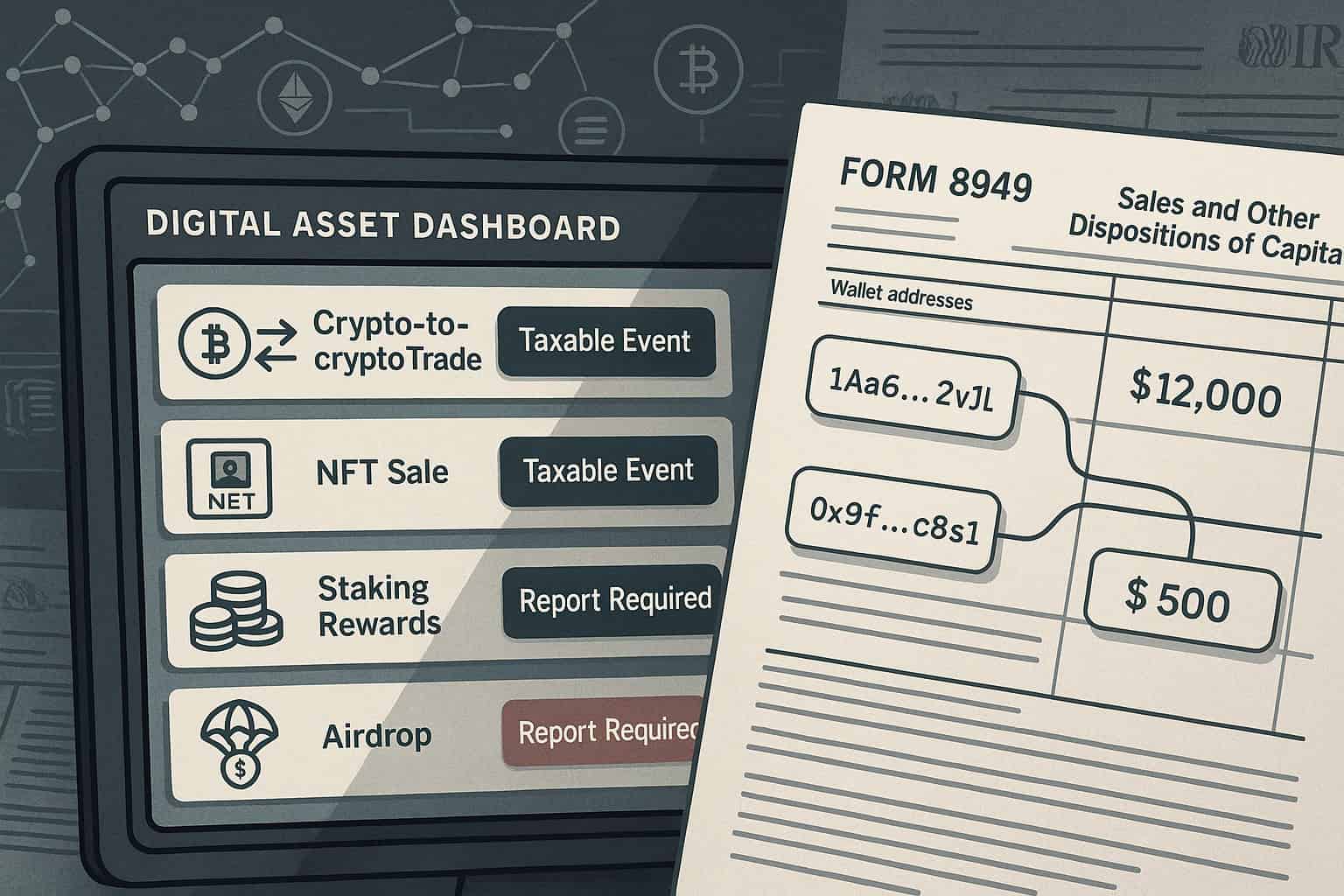

Taxpayers report capital gains and losses on Form 8949, which details sales and other dispositions of capital assets, including virtual currency. The totals from Form 8949 are then transferred to Schedule D of Form 1040, where net capital gains or losses are calculated. Accurate calculation and reporting of capital gains are vital to avoid overpaying taxes or underreporting income.

Reporting Crypto Transactions

All virtual currency transactions must be reported on your federal income tax return. This includes not only sales but also exchanges, purchases, and any other dispositions of digital assets. The IRS requires the fair market value of virtual currency to be reported in U.S. dollars, ensuring consistency in tax reporting.

Maintaining accurate records of every crypto transaction is necessary to comply with the internal revenue code. Taxpayers should document dates, amounts, transaction types, and the fair market value of the virtual currency involved. Many taxpayers find that using crypto tax software simplifies this process by automating calculations of gains and losses and generating necessary tax forms.

Proper reporting of crypto transactions helps taxpayers avoid penalties and ensures compliance with tax law. The IRS has increased enforcement efforts related to virtual currency, so transparency and accuracy in reporting are more important than ever.

Crypto Donations to Charity

Donating virtual currency to a charitable organization can provide tax benefits in the form of a charitable contribution deduction. When you give cryptocurrency as a bona fide gift to a qualified charity, you may claim a deduction equal to the fair market value of the virtual currency at the time of the donation.

To claim this deduction, the IRS requires taxpayers to obtain a receipt from the charitable organization and maintain detailed records of the donation. This documentation should include the date of the gift, the amount donated, and the fair market value of the virtual currency.

Donating digital assets to charity not only supports a worthy cause but can also reduce your tax liability. It is a tax-efficient strategy for managing digital assets, especially if the cryptocurrency has appreciated in value. However, it is essential to follow IRS guidelines carefully to ensure the donation is tax deductible.

Crypto Mining and Staking

Income generated from crypto mining and staking activities is considered taxable ordinary income or self-employment income, depending on the circumstances. The IRS treats cryptocurrency received from mining or staking as income at its fair market value at the time of receipt.

Taxpayers engaged in mining or staking must report this income on their tax returns, typically using Form 1040 and Schedule C to reflect self-employment income. This means the income is subject not only to federal income tax but also to self-employment tax, similar to other business income.

Proper reporting of crypto mining and staking income is essential to comply with tax law and avoid penalties. Tracking the fair market value of virtual currency received and maintaining thorough records will facilitate accurate reporting on your tax return.

Record Keeping for Crypto

Maintaining comprehensive and accurate records of all virtual currency transactions is a critical aspect of complying with IRS crypto tax regulations. Taxpayers should document every purchase, sale, exchange, and other disposition of digital assets, including the date, time, amount, and fair market value at the time of each transaction.

The IRS emphasizes the importance of record keeping to verify reported income, gains, and losses. Using crypto tax software can assist taxpayers in tracking transactions and calculating cost basis, acquisition costs, and other relevant details.

Accurate record keeping not only helps ensure compliance with the internal revenue code but also protects taxpayers in case of an audit. By maintaining detailed records, you can confidently file crypto taxes and demonstrate adherence to tax law requirements.

IRS Crypto Tax Audit

The IRS crypto tax audit has become a significant focus for the Internal Revenue Service as it intensifies efforts to ensure compliance with cryptocurrency tax laws. An IRS crypto tax audit involves a detailed examination of your virtual currency transactions to verify that all taxable income, capital gains, and losses have been accurately reported on your tax returns.

Audits may be triggered by discrepancies in your filings, unreported crypto income, or inconsistencies between reported transactions and information received from crypto exchanges. During the audit, the IRS will request comprehensive documentation, including transaction histories, wallet addresses, cost basis records, and proof of fair market value at the time of each transaction.

To prepare for an IRS crypto tax audit, it is essential to maintain thorough and organized records of all your cryptocurrency activities. Using reliable crypto tax software and consulting with tax professionals experienced in cryptocurrency taxation can help ensure your filings are accurate and supportable. Prompt cooperation and detailed documentation during an audit can facilitate a smoother resolution and minimize potential penalties.

Takeaway

Navigating IRS crypto tax rules can be complex, but understanding how virtual currency is treated for federal income tax purposes is essential for every taxpayer involved in digital asset transactions. From recognizing ordinary income and calculating capital gains to reporting transactions and maintaining records, complying with tax law safeguards you from penalties and ensures your tax return reflects your true tax liability.

Whether you are an investor, independent contractor, miner, or donor, staying informed about crypto taxes and preparing for the possibility of an IRS crypto tax audit will help you manage your digital assets effectively and responsibly.

The Evolving Landscape of Crypto Taxation

The tax treatment of cryptocurrency and other digital assets is complex and continually evolving. The IRS regularly updates its guidance, and new regulatory requirements—such as the upcoming 1099-DA reporting forms,may significantly impact how crypto transactions are reported and taxed.

As the use of virtual currency for compensation and investment grows, understanding the tax implications is essential for individuals and businesses alike. Prioritizing compliance, accurate valuation of virtual currency’s fair market value, and strategic tax planning can help minimize tax liabilities and reduce the risk of IRS enforcement actions.

Partner with Experts for Strategic Crypto Tax Planning

Camuso CPA specializes in working with investors, entrepreneurs, and businesses involved in the digital asset space to develop tailored tax strategies that ensure compliance and optimize tax outcomes.

📞 Schedule your consultation today to ensure your virtual currency transactions are reported accurately and strategically, keeping you ahead in the evolving landscape of IRS crypto tax regulations.