Last Updated on April 5, 2025 by Patrick Camuso, CPA

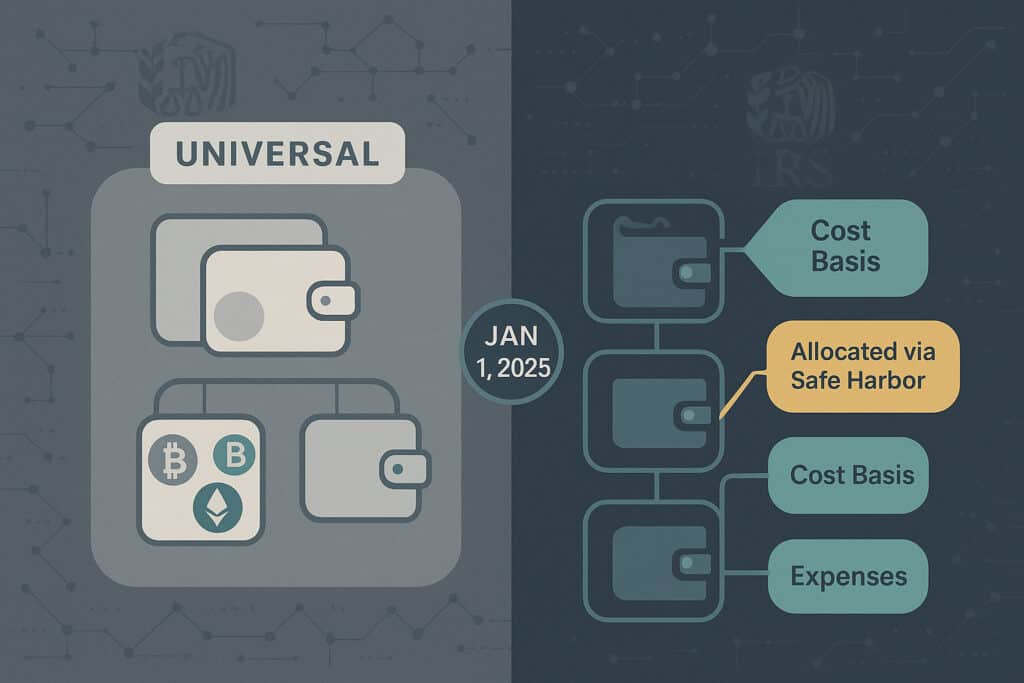

If you are holding digital assets such as cryptocurrencies, staying compliant with the latest IRS rules, that is the rev proc 2024-28, is essential. Many taxpayers have relied on a universal method for cost basis tracking, pooling identical units across multiple wallets or accounts.

However, Revenue Procedure 2024-28 introduces significant changes that require wallet- or account-level basis tracking. This revenue procedure mandates clear, documented methods for reasonable allocation of cost basis to digital asset units held in specific wallets or accounts. Whether you are an individual investor or a broker, understanding these updated rules is critical to ensure compliance and be audit-ready.

This article will walk you through the key changes in Rev Proc 2024 28, explain important terminology, outline deadlines, and provide practical guidance on how to update your accounting processes for digital asset transactions.

By adopting the right allocation methods and maintaining sufficient records, you can confidently navigate the new landscape of digital asset tax reporting.

Key Takeaways

The most important points to understand about Rev Proc 2024 28 include:

- The universal or multi-wallet basis pooling method is no longer allowed. Taxpayers must now track cost basis at the wallet or account level.

- Wallet or account-level basis tracking is required, but you may use standing orders to automate lot identification.

- A safe harbor provision allows taxpayers to allocate unused basis as of January 1, 2025, simplifying the transition from prior practices.

- Allocation methods include specific unit allocation—assigning basis to individual digital asset units—and global allocation, which uses a written rule to allocate basis across wallets.

- Deadlines depend on your first digital asset sale of the year or your tax return due date, whichever comes first.

- Starting with the 2025 tax year, brokers will issue Form 1099-DA reporting gross proceeds from digital asset sales.

- Basis reporting by brokers will begin for transactions on or after January 1, 2026.

These changes represent a significant shift in how taxpayers must approach basis tracking and reporting for digital assets. The elimination of the universal accounting method for digital assets poses challenges for taxpayers managing multiple wallets, requiring more detailed tracking and documentation. To reduce administrative burden, taxpayers can consolidate all digital assets into one account and manage their units of unused basis by December 31, 2024.

Key Changes Under Rev Proc 2024-28

Prior to Rev Proc 2024 28, many taxpayers used a universal method that pooled identical digital asset units from multiple wallets, exchanges, or accounts into a single cost basis pool. This approach allowed flexibility but lacked the granularity the IRS now requires.

The new revenue procedure mandates lot tracking at the wallet or account level. This means you must specifically identify or use FIFO (first in, first out) accounting within each wallet or account when selling digital assets. The method you choose must be documented at the time of sale, and standing orders with brokers are permitted to streamline the process.

To ease the transition relief, Rev Proc 2024 28 provides a safe harbor that allows taxpayers to allocate their remaining unused basis as of January 1, 2025 to each wallet or account holding digital assets. This allocation can be done using either specific unit allocation or a global allocation method. The safe harbor applies only to capital assets held as of January 1, 2025.

Compliance note: The IRS’s final regulations on digital asset lot identification are found in Reg. §1.1012-1(j). Brokers will begin reporting gross proceeds on Form 1099-DA for sales occurring in 2025, and adjusted basis reporting will start in 2026. This means taxpayers must be prepared to track and report basis accurately at the wallet level going forward.

Key Terms in Plain Language

Understanding the following terms is critical guidance for complying with Rev Proc 2024 28:

- Remaining units: These are the digital asset units you still hold in a specific wallet or account as of January 1, 2025.

- Unit of unused basis: The portion of your original cost basis that has not yet been allocated to a sold unit.

- Specific unit allocation: Assigning specific basis amounts to individual remaining digital asset units in each wallet or account, documented in your records.

- Global allocation: A written rule, created before January 1, 2025, that allocates unused basis across wallets or accounts holding the same digital asset.

- Standing order: An ongoing instruction to a broker or an internal rule for selecting which lots to sell, such as FIFO or highest cost first.

These terms help clarify how taxpayers should approach allocating unused basis and tracking digital asset transactions under the new rules.

Deadlines That Matter

Meeting deadlines is crucial to benefit from the safe harbor provisions of Rev Proc 2024 28 for the taxpayer’s digital assets :

- For specific unit allocation, you must complete the allocation before the earlier of your first digital asset sale in the year or your tax return due date, including extensions.

- For global allocation, the written rule must be established before January 1, 2025, and the allocation must be completed by the later of your first sale or tax return due date.

It is important to note the safe harbor applies only to basis and units held as of January 1, 2025 and requires adequate substantiation through your records. Allocating unused basis must be documented clearly to prevent mismatches during income tax reporting and improve IRS compliance.

Failing to meet these deadlines or maintain sufficient documentation removes safe harbor protections, exposing you to potential tax adjustments, penalties, and interest. Failure to follow the new regulations may result in additional tax assessments, penalties, and interest, emphasizing the importance of compliance.

Applying Rev Proc 2024-28 for Digital Asset Basis Allocation

To illustrate the impact of Rev Proc 2024 28, consider this example:

You purchased 1 Bitcoin (BTC) on Kraken for $40,000 and 1 BTC on Coinbase for $60,000 during 2024. As of January 1, 2025, you still hold both units. Later in 2025, you sell 1 BTC from your Coinbase account.

- Under the universal method, you could have used the $60,000 cost basis for the sale regardless of which wallet the BTC was sold from.

- Under the post-2025 rules, you must identify lots at the wallet or account level. Without specific identification, the default FIFO method applies within the Coinbase wallet.

- Using the safe harbor, you can allocate the unused basis as of January 1, 2025, by either specific unit or global allocation to determine which cost basis applies to the sale.

The key takeaway is that you cannot mix basis from Kraken with Coinbase unless you have transfer records showing the lot moved between wallets before the sale.

Standing Orders That Work

To simplify lot identification and ensure compliance, many taxpayers use standing orders. These are pre-established rules or instructions that automatically determine which lots are sold first. Examples include:

- Selling the highest cost per unit first, then by earliest acquisition date, and then by highest total lot cost if there is a tie.

- Applying FIFO within each wallet or account.

- Using specific tax lot IDs based on purchase timestamps and prices, recorded in your ledger.

It is critical to record these standing orders in your books and provide copies to brokers to document your method for tax purposes.

Recordkeeping Checklist

Maintaining sufficient records is essential under the updated rules. For every wallet or account, keep:

- The total remaining digital asset units on January 1, 2025 for each asset.

- For each unit of unused basis: original cost, acquisition date, and source wallet or account.

- A written global allocation rule if you use that method.

- Books and records showing when allocations were completed.

- Standing orders provided to brokers and the date recorded.

- Transfer logs with transaction hashes, from/to addresses, timestamps, and fees.

- Broker statements and CSV exports.

- Annual reconciliation tying ending basis to the next year’s starting basis.

Taxpayers must maintain sufficient records to identify total remaining digital assets in each account by the deadline.

Good recordkeeping reduces administrative burden and ensures audit readiness for basis in digital assets .

Software Setup Tips

Many digital asset users rely on crypto tax softwares to facilitate compliance with Rev Proc 2024 28. To optimize your setup:

- Enable per wallet or account lot tracking.

- Import complete transaction histories, including self-custody and exchange activity.

- Reconcile transfers by matching inbound and outbound records.

- Lock your January 1, 2025 snapshot once reconciled to prevent changes.

- Export an allocation audit file showing your allocation rule and resulting lot mapping.

Taxpayers may use specialized crypto tax software to help automate the allocation of digital assets acquired and unused basis according to new IRS guidelines.

- Enable per wallet or account lot tracking.

- Import complete transaction histories, including self-custody and exchange activity.

- Reconcile transfers by matching inbound and outbound records.

- Lock your January 1, 2025 snapshot once reconciled to prevent changes.

- Export an allocation audit file showing your allocation rule and resulting lot mapping.

Using software that supports wallet-level cost basis tracking is critical to meeting IRS expectations.

Common Pitfalls and Red Flags

Watch out for these common mistakes that can jeopardize your compliance:

- Selling digital assets in 2025 before completing your specific unit allocation.

- Writing a global allocation rule after the January 1, 2025 deadline.

- Allocating basis that has already been used to remaining units.

- Treating an exchange account as a single wallet while mixing in self-custody lots without proper transfer records.

- Using HIFO (highest-in, first-out) without a standing order or timely identification.

Avoiding these pitfalls will help you stay within the IRS’s safe harbor and reduce audit risk.

Expert POV

“The fastest path to compliance is simple: reconcile transfers, map lots by wallet, then put a standing order on file before your first sale. That one workflow eliminates most audit issues we see.”

— Patrick Camuso, CPA

Following this advice can streamline your transition to the new rules and ensure your basis tracking is both accurate and defensible.

Quick Stats

- Brokers must issue Form 1099-DA for digital asset sales occurring in the 2025 tax year, with forms expected in early 2026.

- Basis reporting by custodial brokers begins for transactions on or after January 1, 2026.

- A growing share of U.S. adults have transacted in cryptocurrencies, increasing the importance of compliance scrutiny.

These statistics highlight the increasing regulatory focus on digital assets.

Compliance Notes and Disclaimers

This article provides a high-level summary of IRS guidance and is not intended as tax or legal advice. For detailed rules, refer to:

- Rev Proc 2024 28 for safe harbor allocation rules.

- Reg. §1.1012-1(j) for lot identification requirements.

- IRS guidance on Form 1099-DA for sales reporting.

Consult a qualified tax professional to ensure your specific circumstances are addressed.

Action Plan

To align with Rev Proc 2024 28, follow this eight-step plan:

- Inventory all wallets and accounts holding digital assets.

- Reconcile prior transfers and resolve any missing or incomplete links.

- Choose your allocation method: specific unit or global allocation; write a rule if using global.

- Take a snapshot of your holdings by asset and wallet/account as of January 1, 2025.

- Complete basis allocations by the applicable deadline.

- Record standing orders with brokers and document them in your books.

- Archive all allocation workpapers and supporting records.

- Monitor incoming Form 1099-DA forms in early 2026 and reconcile them with your records.

Book a Strategy Call to set up your allocation plan and standing orders in one session.

FAQs

Can I still use HIFO?

Yes, but only if it is documented through a standing order or written rule established before the sale. Ad hoc HIFO after the fact will not qualify.

Do I need to amend prior years?

Not automatically. The safe harbor is forward-looking but requires substantiation of unused basis amounts.

What about transfers between my wallets?

Maintain clear, detailed records of transfers of digital asset proceeds , including dates, amounts, and basis, to support your allocations.

What if my software only supports universal basis?

Use it for reconciliation, then export data and perform allocation using tools that support wallet/account-level tracking.

About Camuso CPA

At Camuso CPA, we serve digital asset investors and Web3 businesses with precise tax and accounting services. Our mission is to minimize your tax burden, maintain compliance, and provide peace of mind. We were among the first CPA firms to accept cryptocurrency for professional services.

Contact us today to begin your allocation plan for each digital asset sold and set up standing orders to ensure compliance with Rev Proc 2024 28.

Watch the full video: https://youtu.be/UJC0UxcPe9k