Last Updated on February 14, 2026 by Patrick Camuso, CPA

For many digital-asset investors, the prevailing assumption is simple: “I filed every year. I’m done and compliant.”

The risk introduced by Form 1099-DA is a structural change in how crypto activity is evaluated, one that recontextualizes prior filings under a system that now demands reconciliation.

The End of Informal Crypto Compliance

For more than a decade, digital asset taxation operated in a fragmented environment. Reporting was self-directed, tooling was immature and enforcement visibility was limited. Investors made reasonable decisions using the information and systems available at the time.

Filings occurred without:

- Standardized broker reporting

- Proceeds-level matching

- Systemic reconciliation between third-party data and taxpayer records

That environment shaped behavior. Filing a return often meant aggregating exchange exports, relying on early-stage software or working with advisors who lacked crypto-native infrastructure.

The absence of follow-up was interpreted as closure. That interpretation is no longer reliable. Compliance expectations changed because the system matured. Form 1099-DA is the first large-scale test of that transition.

The Digital Asset Compliance Era™

One of the elements of what we call at Camuso CPA, the Digital Asset Compliance Era™ reflects a structural shift in how digital-asset activity is evaluated, enforced and reconciled.

This transition introduces new expectations around documentation, internal consistency, and methodological discipline.

What “I Filed” Actually Meant Before 1099-DA

Historically, filing a crypto tax return meant reporting based on self-curated data in a low-visibility environment. There was no standardized broker feed to validate proceeds. There was no automated system reconciling filings against third-party records.

As a result:

- Filing did not imply validation

- Silence did not imply accuracy

- Absence of enforcement did not imply defensibility

What Form 1099-DA Actually Is (and Is Not)

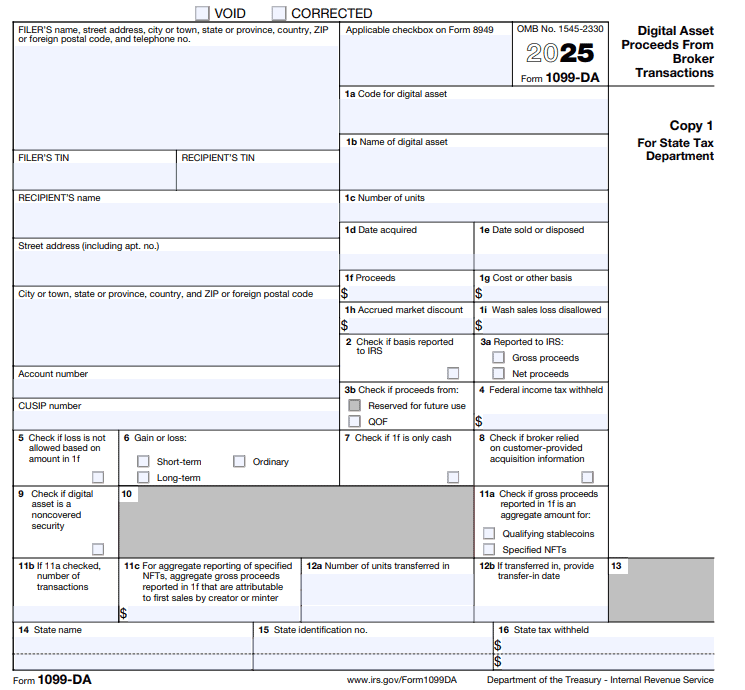

Form 1099-DA is a broker-filed information return issued under Internal Revenue Code §6045. Its function is to report gross proceeds from broker-effectuated digital-asset dispositions.

It is designed to support automated matching and discrepancy detection within IRS systems.

It is not:

- A tax return

- A complete transaction ledger

- A determination that a taxpayer’s filing is incorrect

It represents a partial ledger, one that captures what the broker observed, not the full economic history of the asset.

That distinction is critical. The form is incomplete by design, but it is sufficient to initiate procedural enforcement.

Why Matching Is the Immediate Risk

Enforcement does not begin with audits. It begins with data ingestion.

The workflow is straightforward:

- Information returns are ingested

- Automated matching compares reported proceeds

- Discrepancies trigger correspondence

- CP2000 notices are issued

- Escalation follows if unresolved

Matching systems do not require basis to flag discrepancies. They proceed as if basis is unsubstantiated until the taxpayer establishes otherwise.

This reflects how automated underreporter (AUR) systems function across all asset classes.

Why Cost Basis Is the Breaking Point

Under §6045(g), brokers are only required to report cost basis for covered assets, generally those with continuous custody and sufficient acquisition data.

In crypto, that condition is often unmet.

Cost basis is frequently absent because:

- Assets were acquired before broker tracking began

- Transfers occurred between wallets and platforms

- DeFi activity broke custody lineage

- Early acquisitions predated standardized records

Basis, if missing, must be substantiated by the taxpayer. That substantiation occurs on Form 8949, where adjustments are asserted and defended. This is where most issues will surface.

The Structural Problem: Historical Accounting Debt

Early crypto activity was rarely documented with audit-grade precision. Adequate tooling did not exist, standards were undeveloped and reporting incentives were minimal.

The IRS has repeatedly stated that digital-asset reporting non-compliance is widespread. In practice, many investors require five to ten or more years of historical reconstruction to accurately calculate basis.

Any miscalculations or inaccuracies that carry into basis for assets still held by taxpayers will persist until full historical accounting and cost basis reconstruction are completed.

Why You Cannot “Start Clean” in the 1099-DA Year

Cost basis is cumulative. Errors propagate forward.

A missing acquisition in 2016 affects a sale in 2025. Later dispositions inherit earlier defects.

Form 1099-DA does not expose early activity directly. It exposes unresolved historical accounting failures indirectly, by forcing reconciliation at the point of sale.

There is no clean reset without addressing prior years.

Rev. Proc. 2024-28 and the End of Universal Pooling

Revenue Procedure 2024-28 marked the formal transition away from universal pooling and toward wallet- and account-level cost-basis tracking that aligns with broker-level reporting.

While the procedure does not retroactively invalidate prior filings, it significantly narrows the range of acceptable basis-allocation approaches going forward. Transition relief exists, but it requires disciplined, consistent allocation of historical basis to identifiable units or accounts.

Once standardized third-party reporting enters the system, informal pooling assumptions increasingly fail reconciliation.

Why Software Alone Cannot Solve This

Software performs calculations but it does not reconstruct missing history, establish custody lineage or create substantiation.

The IRS evaluates records and methodology, not tools. Reliance on software does not relieve the taxpayer of recordkeeping obligations under §6001.

Why Notices Are the Worst Time to Discover This

CP2000 notices operate on compressed response timelines. By the time a notice is issued, the IRS’s matching process has already advanced, and the burden has shifted to the taxpayer to reconcile and substantiate the reported position quickly.

That timing collides with practical reality.

The accounting work required to establish defensible cost basis is rarely achievable under notice deadlines. When a notice arrives, the underlying work should already be complete.

Coinbase, Cost Basis, and the Pre–1099-DA Correction Window

Recent updates to Coinbase’s tax infrastructure underscore this transition.

Coinbase has announced:

- 1099-DA availability beginning with 2025 activity

- User-selected cost basis methods

- A one-time historical cost basis submission window

- Bulk updates for missing basis data

This is is a liability handoff.

The existence of a submission process implicitly acknowledges that historical cost basis data is unreliable. Once submitted, that data becomes the exchange’s internal reporting reference point.

After 1099-DA is live, exchange data becomes the IRS baseline. Errors shift from software issues to taxpayer responsibility.

Who This Actually Applies To (and Who It Doesn’t)

This primarily affects:

- Long-term holders

- Multi-exchange users

- DeFi participants

- Founders and early adopters

It is less relevant for:

- Single-exchange, short-term users

- Fully documented custodial activity

Precision matters but not every taxpayer faces the same risk. This is why it’s crucual to work with an experienced Crypto CPA.

The Only Question That Matters Now

The relevant question is no longer: “Did I file?”

It is: “Can this be defended under modern reporting and reconciliation systems?”

Form 1099-DA is the first real stress test of whether historical crypto activity can survive modern compliance scrutiny.

The Digital Asset Compliance Era™ has begun.

Preorder the Crypto Tax Handbook™

The Professional Benchmark for Digital Asset Taxation & Accounting.The Crypto Tax Handbook™ sets the professional benchmark for navigating taxation, accounting, and compliance in the digital asset era.

It translates evolving IRS guidance, enforcement priorities, and accounting standards into a clear, actionable framework for investors, founders, and professionals at the frontier of digital finance.

About Camuso CPA

Camuso CPA is the category leader in digital asset taxation, Web3 accounting, and crypto compliance strategy. Since 2016, the firm has advised founders, investors, protocols, start-ups and family offices navigating the technical, regulatory, and operational complexities of digital assets.

Industry Leadership and Credentials

- Forbes Best-In-State Top CPA 2025

- Featured in Accounting Today for a software-agnostic Web3 accounting methodology

- First U.S. CPA firm to accept cryptocurrency payments

- Digital-asset native CPA firm since 2016

- Pioneer of SegFIFO™, the wallet-level FIFO cost-basis method

- Developer of ChainRecon™, forensic wallet and on-chain reconciliation framework

- Trusted by DeFi protocols, Web3 startups, miners, validators, and high-net-worth crypto investors

- National speakers and advisors on digital asset tax policy and Web3 accounting systems

- Authors of The Crypto Tax Handook and Navigating the NFT Sales Tax Maze books

- AI-enabled infrastructure for real-time insight, audit-ready documentation, and advanced tax strategy

Camuso CPA is built to lead the new compliance era of digital assets, where proper methodology, evidentiary documentation, and rigorous interpretation drive compliant and reliable tax results.

Prepare now for the transition to 1099-DA. Partner with Camuso CPA for audit-ready compliance, follow our newsletter for continuous analysis, subscribe to our podcast The Financial Frontier for expert commentary and preorder the Crypto Tax Handbook to equip yourself with the most current standards.