Last Updated on February 28, 2026 by Patrick Camuso, CPA

Quick answer (read this first):

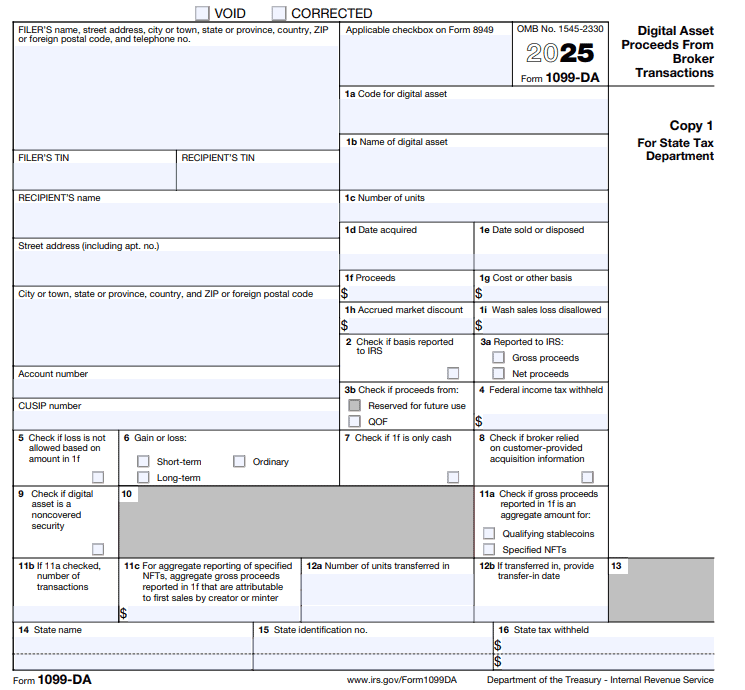

What it is: Form 1099-DA is the IRS information return used to report digital asset sales and exchanges through custodial brokers. It applies to 2025 transactions, with forms generally furnished to taxpayers in 2026.

Why it’s often incomplete: In the first year of reporting, brokers generally report gross proceeds, while cost basis may be missing, especially when assets move between wallets, exchanges, chains, or DeFi environments outside broker visibility.

What to do: Do not prepare your tax return from the 1099-DA alone. You should reconcile the form to your wallet and exchange records, document your cost basis and accounting method, and retain support in anticipation of IRS matching and automated notices.

For the full technical breakdown, including wallet-by-wallet accounting, Rev. Proc. 2024-28, FIFO vs. Specific ID, UTC timestamp issues, and what 1099-DA does not report, continue below.

Form 1099-DA: What It Is, Why It’s Often Wrong, and How to Respond

IRS Form 1099-DA changes how the IRS will verify crypto reporting. Starting with 2025 activity (forms typically delivered in 2026), custodial brokers will report proceeds from certain digital asset sales and exchanges to both taxpayers and the IRS. The compliance risk is not “forgetting crypto”, it’s mismatches created when the broker form is partial, your basis is missing, or your on-chain activity sits outside what the broker can see.

This page is designed as a single reference for taxpayers and advisors navigating Form 1099-DA including what it covers, what it won’t, why mismatches happen, and the recordkeeping workflow that prevents notices and audit friction. This guide explains Form 1099-DA from the IRS’s reporting perspective, the taxpayer’s reporting obligations, and the reconciliation gaps that arise between the two. Where guidance is still evolving, we explain the most defensible interpretation and how to document it.

Common 1099-DA Problems (and why they trigger IRS mismatches)

| Issue | Why It Creates Compliance & Reporting Problems |

|---|---|

| Shift to wallet-by-wallet accounting | Taxpayers who previously treated all wallets as one pool must reconstruct historical basis by wallet or face IRS recalculation and potential audit exposure. |

| FIFO or Specific Identification only | HIFO, LIFO, and optimized tax-lot strategies are permitted only if executed as valid Specific Identification before each disposal which is something most exchanges cannot support and most taxpayers have never documented. |

| Missing or incomplete cost basis on most 1099-DAs | Brokers cannot compute basis for assets acquired before 2026, transferred in/out, bridged, wrapped, or swapped across chains. Cost basis reporting is delayed, leaving taxpayers responsible for reconstruction. |

| Many taxpayers lack defensible wallet-level documentation | IRS guidance and industry experience indicate that a significant portion of taxpayers do not maintain records aligned with wallet-by-wallet reporting, increasing mismatch risk as broker reporting begins. |

| Large categories of DeFi, NFT, and on-chain activity excluded | Wrapping/unwrapping, LP deposits and withdrawals, staking, lending, short sales, and notional principal contract transactions are not reported on 1099-DA but remain taxable, creating unavoidable mismatches. |

| No transfer statements between brokers | Until transfer reporting rules take full effect, cost basis cannot follow assets across platforms. Multi-exchange or multi-wallet users will have fragmented basis and inconsistent IRS data. |

| 1099-DAs may be issued up to a year late | Transitional relief under Notice 2024-56 allows brokers to furnish forms long after tax returns are filed. Taxpayers may receive forms months later that contradict their filed returns, forcing amendments. |

| Brokers will report using UTC instead of local time | A transaction executed on December 31 in a taxpayer’s time zone may appear as a January 1 disposal to the IRS. Misaligned timestamps create year-to-year reporting mismatches and audit flags. |

| Non-custodial DeFi activity generally outside current broker reporting | Many non-custodial protocols do not currently issue Forms 1099-DA, leaving taxable activity outside broker reporting and requiring taxpayer-level reconciliation. |

| Structured broker reporting increases IRS matching capability | Form 1099-DA introduces standardized proceeds data that can be matched against taxpayer filings and existing blockchain analytics, increasing mismatch detection when records are inconsistent. |

| Cost basis reconstruction becomes unavoidable | Any taxpayer with activity across multiple exchanges, wallets, chains, or protocols will need wallet-by-wallet historical basis reconstruction to avoid misreporting, overstated gains, or exposure during exam. |

What Is Form 1099-DA?

Form 1099-DA, Digital Asset Proceeds From Broker Transactions, is the IRS information return that custodial digital asset brokers must use to report certain digital asset sales and exchanges to both taxpayers and the government, beginning with transactions on or after January 1, 2025. It is the implementation vehicle for the broker reporting rules added to Internal Revenue Code §6045 , the Treasury and IRS issued final digital-asset broker reporting regulations requiring qualifying brokers to begin reporting certain sales and exchanges of digital assets that occur on or after January 1, 2025.

Functionally, 1099-DA does for digital assets what Form 1099-B does for securities, it reports gross proceeds (and, over time, adjusted basis and gain/loss) from broker-facilitated disposals. For the 2025 tax year, brokers are generally required to report gross proceeds only; mandatory basis reporting is phased in starting with covered digital assets acquired on or after January 1, 2026.

Who is a “broker” under 1099-DA?

The final regulations clarify that a “digital asset broker” includes any person who, in the ordinary course of business, stands ready to effect sales of digital assets for customers. In practice, this definition includes: centralized exchanges, custodial trading platforms, payment processors that redeem or transfer digital assets, certain hosted-wallet providers, and other custodial intermediaries. Congress used the Congressional Review Act to overturn portions of the final regulations that would have extended broker reporting obligations to certain non-custodial DeFi actors for the 2025–2026 period.

When Treasury issued its proposed digital-asset broker regulations, the definition of a “broker” was broad. It included not only custodial exchanges but also:

- decentralized exchanges (DEXs)

- smart-contract based trading platforms

- AMM and liquidity-pool protocols

- DAO-operated trading interfaces

- wallet software and non-custodial front-ends

This triggered an unusually large comment period and industry response, with significant resistance from the DeFi industry, privacy advocates, digital-rights groups, and even some institutional financial actors.

Treasury released the final digital-asset broker regulations and continued to classify certain DeFi intermediaries as “digital asset brokers.” Under the final rule, any person or platform that allowed customers to sell or exchange digital assets could be treated as a broker, whether or not they had custody. This meant that some DeFi front-ends, interfaces, and operators of smart-contract based trading systems were still within scope.

In early 2025, Congress used the Congressional Review Act (CRA) to overturn the part of the final regulations that extended broker-reporting obligations to non-custodial DeFi actors. The resolution passed, and as a result only custodial brokers remain subject to Form 1099-DA for 2025 and 2026 reporting

What counts as a “digital asset” under 1099-DA?

The regulations define digital assets broadly. The types of assets that may trigger 1099-DA reporting include:

- Cryptocurrencies (e.g., Bitcoin, Ethereum, Solana)

- Stablecoins

- Non-fungible tokens (NFTs) and fractional NFTs

- DeFi / governance tokens

- Tokenized real-world assets (RWAs) and other tokenized representations of value when handled by a broker

What 1099-DA Reports (2025 vs. 2026 and Beyond)

For 2025 transactions, brokers are required to report only gross proceeds, not cost basis. Basis reporting is optional in 2025. Starting January 1, 2026, for “covered” digital assets (those acquired and held in the same broker account), brokers must report both gross proceeds and adjusted basis, facilitating automatic gain/loss reporting.

For noncovered assets (e.g., transferred-in tokens, cross-wallets, assets acquired before 2026, etc.), basis reporting remains optional, though brokers may furnish substitute statements.

What 1099-DA Does Not (Yet) Cover

Despite its broad new reporting framework, 1099-DA will not capture many common digital-asset events. The IRS itself carved out a range of activities under Notice 2024-57, granting brokers temporary relief from reporting responsibilities for “identified transactions” until further guidance.

- Wrapping and unwrapping transactions

- Liquidity provider transactions

- Staking transactions

- Transactions described as lending of digital assets

- Transactions described as short sales of digital assets

- Notional principal contract transactions

- The form does not cover purely on-chain swaps, smart-contract interactions, AMM trades, staking rewards, or other DeFi-native mechanics when they occur outside a custodial broker environment.

- For 2025 transactions, 1099-DA will generally omit cost basis and gain/loss information, creating material gaps for many investors.

Why This Matters for Crypto Investors, Founders & Web3 Businesses

With 1099-DA omitting basis in 2025 and many assets likely to be noncovered, investors and founders must maintain wallet-level historical records and reconstruct cost basis manually or via professional support. Despite not being reportable via 1099-DA, these events remain fully relevant for tax purposes.

Non-reported but taxable events including DeFi, staking, lending, LP activity, bridging, even though these may not generate 1099-DA, may trigger tax events. Failure to self-report accurately creates audit and penalty risk.

As the IRS begins to cross-reference 1099-DA data with blockchain analytics and wallet-clustering tools, any unreported or mis-documented transaction becomes exposure. Compliance readiness is needed now. Even before 2026 mandatory basis reporting, taxpayers should prepare systems for basis tracking, cost-basis reconstruction, and full transaction attribution across wallets, chains, and platforms.

Form 1099-DA represents a fundamental shift that brings much of digital asset market activity under the lens of traditional broker-reporting frameworks. But it does not solve the core challenges of on-chain complexity, cross-platform transfers, or non-custodial activity. For serious market participants, from high-net-worth investors to founders, protocols, funds, and Web3 businesses, Form 1099-DA offers a partial ledger, not a full one. Compliance, defensive documentation, and careful cost-basis reconstruction remain critical.

At Camuso CPA, we’ve reconstructed digital asset histories since 2016. We call the next phase the“Digital Asset Compliance Era”: a reporting environment where your on-chain and off-chain footprints are expected to align with what the IRS receives.

The Universal Accounting Method Is Dead for Digital Assets: Mandatory Wallet-by-Wallet Accounting (Effective 1/1/2025)

For years, many taxpayers used the “universal method” of cost-basis tracking by treating all wallets and accounts as a single aggregated pool. Under that approach, taxpayers could select lots across any wallet they controlled, even if the disposal occurred from a different wallet.

Example:

Under the universal method, if a taxpayer sold 1 ETH from a Ledger hardware wallet, they could elect to use a higher-basis lot that originally came from their Kraken account, even though those units never left Kraken. Under wallet-by-wallet accounting, this is no longer allowed. The disposal must be matched only to lots held within the Ledger wallet.

The IRS has formally eliminated the universal method in connection with the new broker-reporting regime under §6045. Digital asset cost basis, holding periods, and tax-lot identification must now be determined wallet-by-wallet or account-by-account.

The Wallet-by-Wallet Requirement (New Mandatory Rule)

Under the post-2024 rules, taxpayers must use lots held in the same wallet or account from which the disposal occurs. Each wallet functions as a separate cost-basis ledger, and lots cannot be mixed across wallets. This shift creates significant tax and operational consequences:

- Each wallet becomes its own accounting silo for basis, holding period, and lot relief.

- Returns filed using the universal method after 1/1/2025 are vulnerable to IRS challenge, adjustments, or exam inquiries.

- Multi-year reconstruction may be required where records are incomplete or where transfers broke historical lot-tracking continuity.

For active traders, multi-chain users, NFT collectors, DeFi participants, and long-term holders who used multiple platforms, this transition is non-trivial and complex.

Rev. Proc. 2024-28: The Transition Safe Harbor

To ease the transition from universal to wallet-by-wallet accounting, the IRS issued Revenue Procedure 2024-28, offering a one-time, elective safe harbor.

Taxpayers could, for transition purposes:

- Allocate unused basis to specific units, or

- Spread remaining basis across a pool of units within each wallet

For most taxpayers, the safe-harbor window has already closed.

If you missed the safe harbor you must still transition to wallet-by-wallet accounting for 2025 onward, but without penalty relief. That means:

- No protection if the IRS disagrees with your prior universal-method application

- No shield from potential adjustments if lot selection was previously inaccurate

This creates a high likelihood of mismatches between taxpayer-reported basis and broker-reported data beginning with 2025 Forms 1099-DA unless the taxpayer proactively transitoins to account based tracking their historical wallet-level basis.

Why This Matters: The IRS’s Reporting View Will Not Match the Universal Method

Because brokers will report basis only for covered digital assets they continuously held and because basis reporting for 2025 is limited to gross proceeds, the IRS will begin receiving data structured on an account-specific framework. Any taxpayer still using universal-style aggregation will create structural mismatches between their return and the IRS’s data architecture.

Those mismatches drive:

- CP2000 notices

- underreporting flags

- exam inquiries

- reconstructions upon audit

Given that most taxpayers historically used the universal method, this transition is expected to produce widespread discrepancies unless proactively corrected.

Industry Split: Diverging Interpretations of Wallet-by-Wallet Accounting

Although the elimination of the universal method appears straightforward, practitioners are not unified in how to operationalize “wallet-by-wallet” accounting. The underlying IRS guidance requires cost basis to be determined on a wallet or account basis, but it does not define what constitutes a “wallet” for tax-lot purposes. This ambiguity has produced three major schools of thought within the crypto tax profession.

Below is the landscape as of 2025.

Interpretation #1: Strict Wallet-by-Wallet

Each discrete wallet or account functions as its own independent cost-basis ledger.

- One Metamask address = one wallet

- One Ledger address = one wallet

- One Coinbase account = one wallet

- One CEX sub-account = one wallet

- One cold-storage address = one wallet

This interpretation aligns most closely with:

- Rev. Proc. 2024-28

- The §6045 reporting architecture

- 1099-DA design (per account)

- Covered digital asset rules beginning in 2026

- Transfer statement requirements

- IRS examples and modeling of basis integrity

It is the most defensible position for individuals, investors, founders, and most businesses.

Interpretation #2: Wallet “Batching” or Account Aggregation (Used by Some Practitioners)

Some firms take a looser view and aggregate multiple wallets if they:

- Share the same seed phrase

- Are part of the same Metamask application

- Are the same hardware device with multiple addresses

- Are CEX accounts with multiple sub-ledgers

- Reflect multiple derivation paths

- Belong to the same corporate treasury function

This approach is driven by:

- Software limitations

- Legacy universal-method conditioning

- Pressure to simplify compliance

- Client throughput constraints

- Lack of explicit definition of “wallet” in the regulations

One of the most under-discussed issues in the digital asset reporting regime is that the IRS requires wallet-by-wallet accounting but has never formally defined what a “wallet” is for tax-lot purposes.

This creates significant ambiguity for:

- Bitcoin (UTXO model wallets)

- HD wallets with multiple derivation paths

- Wallet clients that generate dozens or hundreds of addresses automatically

- Multisig wallets

- Smart-contract based wallets

- Enterprise treasury setups with internal routing addresses

- Lightning channels

- State channels and rollup sequencer addresses

- Cold wallets with multiple accounts/paths

- Layer-2 addresses derived from Layer-1 keys

Because the IRS never addressed this technical reality, taxpayers and practitioners must determine what constitutes the actual “unit of account” for basis tracking, a deeply technical question with material tax consequences.

Interpretation #3: Hybrid Approach

A small segment of practitioners use a hybrid model, treating:

- Custodial accounts separately

- But non-custodial wallets grouped

- With exceptions depending on asset flow

- Or using batching only for high-volume, high-friction chains

This introduces inconsistent internal logic, making future audits or IRS data-matching far more complex.

Case Administrative Exception for Complex Entities

Camuso CPA maintains a primary, default position aligned with strict wallet-by-wallet accounting because it is most consistent with:

- The IRS’s technical architecture

- 1099-DA and §6045 broker reporting

- Rev. Proc. 2024-28’s structure

- Audit defensibility

- Basis propagation rules

- Future covered-asset reporting beginning 2026

However, unlike software-driven approaches that apply a rigid rule across all taxpayers, Camuso CPA applies a case-by-case administrative feasibility analysis for large enterprises or highly complex Web3 organizations.

When case-by-case exceptions may be considered:

- Enterprise-level treasuries with hundreds or thousands of addresses

- Protocols or DAOs using smart contract-controlled wallets with multisig fragmentation

- Businesses where addresses represent automated operational functions

- Clients where strict segregation creates a compliance burden disproportionate to IRS reporting capability

- Corporate structures where certain “addresses” represent system-level functions rather than economically distinct assets

Camuso CPA evaluates:

- Materiality

- Actual economic segregation

- Audit risk

- Operational reality

- Alignment with 1099-DA architecture

- Whether batching would distort basis or produce mismatches

- Administrative feasibility under AICPA Statements on Standards for Tax Services (SSTS)

If strict segregation creates distortion or is operationally impossible, we develop a documented, defensible unit-of-account policy for that client, supported by:

Internal memos

- Basis reconciliation maps

- Traceable asset-flow diagrams

- Reconciliation narratives suitable for IRS exam

Why This Matters for 1099-DA Alignment

Brokers will report basis and proceeds per account. The IRS will match data per account.

If a taxpayer aggregates wallets in a way inconsistent with broker-level reporting, they risk:

- CP2000 mismatch notices

- Adjusted gain/loss calculations

- Disallowed losses

- Reconstruction demands during examination

- Penalties for inadequate substantiation

Your approach must match the IRS’s architecture.

FIFO, Specific ID & the Death of Improper Tax-Lot Cherry-Picking

The transition framework in Rev. Proc. 2024-28 materially alter how taxpayers may determine tax lots for digital asset dispositions beginning January 1, 2025. These rules interact directly with Treas. Reg. §1.1012-1(c), which governs identification of lots for property subject to capital gain or loss.

Only two methods are permitted for digital asset dispositions: (1) FIFO as the default, and (2) Specific Identification strictly as defined under §1.1012-1(c). All “tax optimization strategies” (HIFO, LIFO, or algorithmic lot ranking) survive only to the extent that they operate as valid Specific Identification under the statute, regulations, and transitional relief.

This eliminates the long-standing industry practice, prevalent for over a decade, of retroactive or software-generated lot selection, which never satisfied the identification requirements under §1.1012-1(c), even before the new rules.

Permissible Methods Under Revenue Procedure 2024-28

FIFO (Default)

FIFO applies whenever a taxpayer fails to make a pre-disposition identification that satisfies:

- §1.1012-1(c)(1) (identification requirements), and

- §1.1012-1(c)(2) (broker confirmation rules, where applicable).

Under §6045 and the final regulations, broker reporting will default to FIFO, and taxpayers must reconcile their records to the broker’s information return absent a valid contrary identification.

Specific Identification

A taxpayer may depart from FIFO only if the taxpayer:

- Identifies the specific unit(s) to be disposed of

- Before the disposition is executed

- With sufficient records to establish

- the acquisition date,

- the cost or other basis, and

- the particular unit disposed of

- Maintains documentation consistent with §1.1012-1(c) and Rev. Proc. 2024-28

- Uses a unit held in the same wallet (or account) from which the disposition occurs

This precludes the practices of:

- Retroactive lot selection

- Software-based “re-optimization” after the fact

- Basis substitution across wallets

- Basis aggregation inconsistent with the functional wallet definition

- Selecting a lot after reconciling CSV files or exchange reports

- Reconstructing “intended” identification post-disposition

Standing Orders as Valid Pre-Disposal Identification (When Properly Structured)

The final regulations reaffirm that a taxpayer may satisfy the pre-disposition identification requirement of Specific Identification by using standing written instructions delivered to a broker or documented in a wallet before any relevant sale occurs, provided those instructions:

- Identify the precise lot-selection methodology (e.g., “highest-basis unit,” “lowest-basis unit,” “last-in unit,” etc.);

- Apply exclusively to units held in the same wallet or account from which the disposition will be executed;

- Remain operative at the time of the transaction; and

- Are retained as part of the taxpayer’s permanent records, consistent with §6001.

Broker confirmations are ordinarily required for adequate identification. However, under Notice 2025-7’s transitional relief, standing orders may function as adequate identification during 2025 even where broker confirmations are not available, so long as the taxpayer’s records demonstrate pre-trade intent and the identification corresponds to the specific wallet/account involved.

In other words, a taxpayer may use HIFO, LIFO, or any optimized variant of Specific ID if they enter a compliant standing instruction before the sale and the instruction exclusively governs that wallet or account. This is the only practical path for most taxpayers to use a non-FIFO method under the post-2024 regime.

A defensible standing order must include:

- Identification Method: The exact rule governing lot selection (e.g., “sell the unit with the highest cost basis in this account,” or “sell the unit acquired last”).

- Wallet/Account Scope: A statement specifying which wallet/account the order applies to.

- Pre-Disposition Timing: The date the order was adopted, which must precede every covered sale.

- Revocation/Modification Protocol:A mechanism documenting changes, ensuring the taxpayer cannot “backdate intent.”

- Record Retention: The taxpayer must permanently retain the written instruction and any subsequent modifications.

This creates a continuous pre-trade identification framework that satisfies §1.1012-1(c) without requiring per-trade manual identification.

Standing instructions must be:

- Prospective, not retrospective,

- Lot-specific by rule, not by reconstruction, and

- Aligned with lots actually held in the wallet at the time of sale.

They cannot:

- Justify after-the-fact “best lot” selection

- Pull units from other wallets

- Override discrepancies between taxpayer records and broker §6045 reporting

- Function as a “catch-all” to cover misidentified or missing lots

This is where most “HIFO software” and post-trade optimization engines fail. Standing orders must govern the sale at the time of execution, not merely describe a desired tax outcome after the fact.

Camuso CPA’s Position Since 2016

Our firm has consistently taken the position that:

- Specific ID must be pre-disposition

- Post-trade “cherry-picking” was never valid under §1.1012-1(c)

Rev. Proc. 2024-28 confirm that this methodology is the correct interpretation.

Why 1099-DA Will Not Calculate Your Gains: The Basis Problem No One Is Prepared For

The single most damaging misconception taxpayers have about Form 1099-DA is: “My exchange will calculate my gains for me.” Brokers will report proceeds, dates, and dispositions, but the IRS has explicitly structured the reporting regime so that most cost basis will be missing, incomplete, or technically unusable for large portions of the population.

This is not a glitch. It is a direct consequence of how the final regulations were designed.

Basis Reporting Is Delayed for All 2025 Dispositions

Under TD 9992 and the phased implementation of §6045, brokers are not required to report cost basis for any digital asset sold in calendar year 2025. This means every 1099-DA issued for 2025 transactions will show:

- Proceeds → Yes

- Cost basis → Frequently blank

2025 is a transitional year where the IRS is collecting proceeds-level data without requiring basis-level data. This alone guarantees mismatches between what taxpayers report and what the IRS receives.

Brokers Know Basis Only When the Asset Never Left Their Platform

Under §6045, a broker can report basis only if they have complete custody records tracing the asset from acquisition to disposition. This almost never exists in crypto. As soon as you do any of the following, the broker’s basis visibility is permanently broken.:

- Send coins to a hardware wallet

- Move to a DEX

- Bridge to another chain

- Stake on-chain

- Migrate to an L2

- Wrap / unwrap an asset

- Provide liquidity

- Mint an NFT

- Transfer between exchanges

Because §6045 adopts the wallet/account-level definition, a broker can only report basis for assets:

- Acquired on its platform, and

- Held continuously without ever leaving that platform, and

- Where the broker has complete cost-basis lineage.

For most taxpayers, that is a small subset of their transaction history.

Transfer Statements Between Brokers Will Not Exist For 2025

Transfer statements between brokers was supposed to function like it does in securities. The final regulations postpone this requirement. Until transfer statements are mandatory and functioning, broker-to-broker basis lineage does not exist in the digital asset ecosystem. Even when covered-asset basis reporting begins, digital assets acquired before 1/1/2026 are grandfathered out. This is the largest “blind spot” in the system and affects tens of millions of transactions.

The result will be millions of 1099-DAs that will be incomplete or technically misleading.

A typical high-volume taxpayer will encounter:

- Proceeds reported

- Basis blank or wrong

- Wallet/account mismatches

- UTC timestamp mismatches

- Missing acquisition data

- Missing disposition-level details

- Missing information for DeFi/NFT/LP activity that remains fully taxable

This will trigger automated IRS mismatch notices unless the taxpayer maintains correct independent records and accruate tax reporting.

Example: The Classic “Basis Missing” Trap

Scenario:

- Bought BTC in 2019 on Kraken

- Transferred to Ledger

- Moved to Coinbase in 2025

- Sold on Coinbase in 2025

What Coinbase Will Report:

- Proceeds: $1,000,000

- Cost Basis: blank (legacy asset + no transfer statement + off-platform history)

What the IRS Will See:

- 1099-DA reports $1,000,000 in proceeds

- With no corresponding basis data

- IRS auto-matching algorithm flags discrepancy if not properly reported

Taxpayer Risk:

- CP2000 underreporting notice

- Increased exam risk

- Potential penalties if basis cannot be substantiated

- Multi-year reconstruction required after the fact

This scenario will apply to millions of taxpayers.

Not All Crypto Transactions Will Appear on a 1099-DA (And Many of the Most Complex Ones Never Will)

A critical point most taxpayers and many practitioners misunderstand is that Form 1099-DA does not capture every taxable digital asset transaction. Under Notice 2024-57, the IRS provided a temporary exception from the information-reporting requirements of §6045 for a specific set of “identified transactions.” This exception relieves brokers from reporting, but it does not relieve taxpayers from recognizing income or gain.

Notice 2024-57 states that brokers are not required to file information returns or furnish payee statements for the following six categories until further guidance is issued:

- Wrapping and unwrapping transactions (e.g., ETH ↔ WETH, BTC ↔ WBTC; chain-wrapped and unwrapped tokens)

- Liquidity provider (LP) transactions (adding/removing liquidity; minting/burning LP tokens)

- Staking transactions (including on-chain, liquid staking, restaking, validator reward mechanisms)

- Lending of digital assets (as described in the notice; includes protocol-based lending arrangements)

- Short sales of digital assets

- Notional principal contract (NPC) transactions (including perpetual futures and derivative-like arrangements described by the industry as NPCs)

The IRS has not declared these transactions non-taxable. It has only declared them temporarily outside the broker reporting regime and penalty framework under §6045. This is the gap that will cause the most confusion and the most enforcement activity.

Why This Matters: The Exceptions Are the Hardest Transactions to Report

The six excepted categories are precisely the digital asset activities where:

- Basis determination is complex

- Characterization is disputed

- Timing is non-obvious

- Multi-step transactions are common

- Existing broker systems cannot capture the economics

Yet taxpayers remain fully responsible for reporting the underlying income, gain, or loss.

De Minimis Thresholds for Broker Reporting

The final regulations also introduce annual de minimis thresholds, exempting brokers from reporting certain smaller transactions involving:

- Qualified Stablecoins: Reporting threshold: $10,000 per year

- Specified NFTs: Reporting threshold: $600 per year

These thresholds relieve brokers, not taxpayers. Even if a disposal is below the reporting threshold, the taxpayer must:

- Determine basis

- Compute gain or loss

- Report the transaction on their return

- Maintain records sufficient to substantiate treatment

The de minimis rules reduce broker burdens, they do not reduce tax liability or reporting obligations.

The Practical Consequence: Your 1099-DA Will Be Incomplete by Design

A 1099-DA will currently not include:

- DeFi swaps

- LP token minting/burning

- Staking or validator rewards

- Wrapped/bridged asset transformations

- Lending and rehypothecation flows

- NFT mint transactions

- Many NFT sales under $600

- Stablecoin transactions under $10,000

- UTXO reorganizations

- Smart-contract level transfers

- Internal wallet movements

- Airdrops, forks, MEV, rebates, restaking returns

Yet all of these have tax consequences under existing guidance.

This is why relying solely on 1099-DA is a guaranteed path to:

- Underreporting

- IRS mismatch notices

- CP2000 letters

- Examinations

- Multi-year reconstructions

Late 1099-DAs: The “Good-Faith” Relief That Exposes Taxpayers to Serious Risk

Under Notice 2024-56, the IRS granted transitional penalty relief for digital asset brokers during the first year of the 1099-DA regime. Brokers may issue Forms 1099-DA up to 12 months late without penalty if they are making a “good-faith effort” to comply.

This rule exists because:

- Brokers are still building §6045 digital asset reporting systems

- Basis reporting is delayed

- Covered asset tracking and transfer statements are not yet operational

- Many platforms lack consistent acquisition-date data

- Wallet/account segmentation is new and technically complex

From a broker perspective, this is reasonable. From a taxpayer perspective, it is a compliance landmine.

Why Late 1099-DAs Create Taxpayer Exposure

Because 1099-DAs can be issued months after the April filing deadline, taxpayers will experience:

- Proceeds reported to IRS that do not appear on their originally filed returns

- IRS mismatch algorithms flagging underreported income

- CP2000 notices demanding tax on unreported gains

- Forced amendments or examination-level substantiation

- Timing mismatches due to UTC reporting versus local-time tax reporting

- Multi-wallet or multi-exchange discrepancies

The IRS’s data ingestion systems (including automated matching) do not account for transitional chaos. If the IRS receives a 1099-DA with proceeds that do not appear on Form 8949, it assumes underreporting unless the taxpayer can prove otherwise.

A Future Common Real-World Scenario (This Will Happen at Scale)

April 2026 You file your 2025 return using your own reconciliation records.

December 2026 A broker, operating under Notice 2024-56 good-faith relief, issues a late 1099-DA.

The form reports proceeds that:

- Did not appear on your return

- May include disposals reported in UTC

- May reflect transactions you already included but at different timestamps

- May capture activity you conducted in a wallet/account you forgot to aggregate

February 2027 You receive a CP2000 underreporting notice demanding tax on “unreported” proceeds. If the data on the 1099-DA is incomplete or incorrect, and it likely will be, you now must:

- Prove your original basis

- Produce wallet-by-wallet records

- Explain timing discrepancies

- Provide documentation the IRS expects brokers to provide in future years

- Potentially amend your return

The only defensible approach is to not rely on 1099-DAs to prepare your return. Prepare your digital asset tax reporting independently. The 1099-DA is the beginning of IRS visibility, not a substitute for proper accounting or tax reporting.

Broker Reporting Will Use UTC, Not Your Local Time Zone

Under the final §6045 digital asset broker regulations, brokers are required to report the date and time of digital asset dispositions using Coordinated Universal Time (UTC) for consistency across platforms and jurisdictions.

This requirement appears minor. In practice, it will create systematic timing mismatches between:

- The broker’s Form 1099-DA

- The taxpayer’s local-time tax year

- The IRS’s automated matching systems

Because U.S. taxpayers report income based on their local time zone, not UTC, a single transaction can be assigned to two different tax years depending on which standard is used.

A Example of the UTC Problem

Taxpayer: Located in Eastern Time (EST) Event: Sells ETH on December 31, 2025 at 10:00 PM EST. Equivalent UTC time: January 1, 2026 at 03:00 UTC.

Your records (local time):

- Sale occurs in 2025

- Reported on your 2025 Form 8949

- Broker’s 1099-DA (UTC time):

- Reports the same sale in 2026

- Appears on the 2026 Form 1099-DA provided to IRS

IRS Automated Matching:

- IRS sees proceeds in 2026 (per 1099-DA)

- IRS sees no corresponding proceeds in 2026 return

- IRS flags the taxpayer for underreporting

- Potential CP2000 notice unless taxpayer can reconcile timing differences

This issue will be pervasive, especially around:

- Year-end trading

- Automated trading strategies

- Staking reward distributions

- Cross-chain bridge settlement times

- DeFi protocol interactions

- Late-night or high-frequency trades

The IRS has not yet updated its mismatching logic to account for this structural timing discrepancy.

Why UTC Reporting Will Create Widespread Compliance Issues

The UTC rule makes sense from a broker-engineering perspective since it standardizes timestamps across platforms.

But from a taxpayer perspective, it leads to:

- Year-end reporting mismatches

- Two different “tax years” for the same event

- Duplicate or omitted transactions

- Incorrect basis ordering for FIFO or Specific ID

- Discrepancies in gain/loss calculations

- Higher audit risk at year-end

- Difficulty reconciling multi-exchange histories

- Conflicts between wallet-level and broker-level reporting

These mismatches will disproportionately affect:

- High-frequency traders

- DeFi users

- Night-time or international traders

- Businesses with automated execution

- Anyone who trades late on December 31

Camuso CPA’s Approach: Dual-Time Reconciliation (UTC + Local Time)

Our reconciliation process already accounts for this regulatory gap. Camuso CPA maintains:

- UTC-based transaction logs to match broker 1099-DAs and §6045 reporting

- Local-time ledgers aligned with taxpayer reporting requirements

- Dual-timestamp matching for every transaction

- Year-end anomaly detection for timing disputes

- Audit-ready documentation explaining variances between UTC and local timestamps

This ensures:

- Accurate Form 8949 reporting

- Correct FIFO or Specific ID ordering under the wallet-by-wallet rule

- Prevention of false mismatches

- Faster resolution of IRS notices

- Defensible explanations during examinations

Until the IRS updates its matching algorithms, taxpayers will need both timestamp standards to avoid erroneous enforcement actions.

Why DeFi, NFTs, MEV, Bridges, Wrapping, and L2s Will Never Be Fully Captured by 1099-DA

The 1099-DA is built for broker-facilitated dispositions, not on-chain activity. The IRS expects taxpayers to track transactions that 1099-DA does not and cannot see. This is where most practitioners fail, most software breaks, and most taxpayers are exposed. This is why it’s crucual to work with an experienced Crypto CPA.

DeFi: Entire Economies Outside Broker Visibility

1099-DA applies to brokers under §6045.

DeFi protocols are not currently treated as brokers.

A broker cannot observe:

- LP token minting and burning

- AMM routing paths

- Slippage components

- Internal contract transfers

- Rebase or auto-compounding events

- Yield strategies that restructure basis

- Liquidations and unwinds

- Collateral swaps in lending protocols

- Multi-hop swaps via aggregators

Yet all of these change basis, holding period, character and taxable income.

NFTs: High-Value Assets With Zero Broker Reporting Infrastructure

Many NFT marketplaces might be brokers under §6045, but most transactions occur on-chain, peer-to-peer, or through smart-contract auctions.

Brokers cannot determine:

- Original mint cost

- Gas spent during mint (basis vs expense)

- Secondary-market provenance

- Bundled NFT transactions

- Fractional NFT allocations

Bridges, L2s, and Wrapped Assets: Structural Basis Distortions

Bridging and wrapping often:

- Change token formats

- Create a new token contract

- Destroy and re-mint assets

- Split/merge token IDs

- Trigger events economically equivalent to a disposition + reacquisition

- Occur across chains with different block timestamps

- Lose historical basis if not tracked manually

Brokers cannot see:

- What occurred before the asset arrived on their platform

- Contract-level transformations

- Bridged token metadata

- Wrapped token lineage

- L2 settlement inflows

- Cross-chain canonical vs non-canonical variations

Yet the IRC requires taxpayers to compute gain or loss using cost basis at the unit level.

This creates mismatches between:

- Broker reporting

- Taxpayer reporting

- On-chain economic reality

How the IRS Will Use 1099-DA: The Enforcement Wave Behind the New Reporting Regime

Form 1099-DA is the missing structural component in the IRS’s digital-asset enforcement architecture. For years, the agency has invested in chain analytics infrastructure, identity-resolution tooling, multi-jurisdiction data feeds, and algorithmic matching engines. What it lacked was a standardized, broker-sourced, taxpayer-linked data pipeline.

1099-DA provides that pipeline. Beginning with 2025 transactions, the IRS will receive structured, machine-readable digital-asset disposition data that can be ingested directly into its automated matching systems and cross-referenced against:

- blockchain analytics

- wallet attribution databases

- subpoena-derived KYC data

- OFAC and AML datasets

- historic 1099-K / 1099-MISC / 5498 activity

- exchange platform data obtained through compliance audits

This connects every custodial disposal to the taxpayer’s identity and provides an anchor point for mapping the taxpayer’s broader on-chain footprint. It establishes the beginning of what we have long predicted at Camuso CPA, the Compliance Era for Digital Assets, an era where voluntary reporting is replaced by algorithmic detection and evidentiary substantiation.

What IRS Enforcement Will Look Like Under 1099-DA

The IRS will integrate 1099-DA data into its existing IRDM (Information Returns Document Matching) and DIF (Discriminant Index Function) scoring models, augmented by commercial blockchain intelligence. Expect the following enforcement vectors to be applied systematically, not selectively:

Structured gross-proceeds data from 1099-DA will be matched against Form 8949 and Schedule D. Any absence, inconsistency, or basis discrepancy results in automated underreporting notices.

AI-driven wallet clustering and entity resolution

The IRS will use ML models similar to those used by commercial chain-tracing platforms. These models infer wallet ownership based on transfer patterns, address co-usage, behavioral signatures, timing correlations, and hop analysis.

Multi-wallet consolidation heuristics

Transfers between hot wallets, cold storage, custodial accounts, DEX entry/exit points, and bridge inflows create a chain-of-custody pattern that analytics engines identify as a single economic actor—even when KYC is absent.

Transfer pattern analytics

Algorithms can detect self-transfers, internal reorganizations, and concealed disposition events by analyzing multi-hop paths, UTXO consolidation, rollup settlement flows, and gas-spending patterns.

NFT marketplace subpoenas

High-value NFT sales and pseudonymous auctions will be cross-referenced with marketplace KYC, payment rails, and wallet attribution datasets.

Stablecoin transaction pattern analysis

Even if stablecoin dispositions fall under de minimis thresholds, inflows/outflows, redemption flows, and routing patterns will be used to validate economic activity and detect omitted taxable events.

Cross-chain and wrapped-asset heuristics

Cross-chain bridges, canonical/non-canonical assets, wrapping/unwrapping events, and L2 settlement flows reveal disposition economics not reflected on 1099-DA. These algorithms reconstruct likely gain/loss events for examination targeting.

Why 1099-DA Unlocks This Enforcement Capability

Before 1099-DA, the IRS had visibility into blockchain activity but lacked identity-anchored transactional data. With 1099-DA, the IRS obtains:

- identified gross proceeds per custodial account

- standardized timestamps (UTC)

- asset identifiers

- account-level reporting that corresponds to wallet segmentation rules

- a consistent key to match broker disposals with on-chain movement patterns

Once a taxpayer disposes of a digital asset through a broker, that transaction becomes the anchor point for reconstructing the inbound movements of that asset and everything associated with it. This frustrates the “off-chain blind spot” assumption many taxpayers relied on.

A New Enforcement Reality: From Self-Reported to System-Detected

The IRS no longer needs to understand every DeFi contract, MEV extraction pattern, NFT mint pathway, or bridge mechanism. It needs to detect only the gaps between:

- What the broker reports (1099-DA)

- What the taxpayer reports (Form 8949)

- What the blockchain shows (address clustering + flows)

Any inconsistency triggers an automated enforcement vector.

This is why the arrival of Form 1099-DA is not an administrative update. It is the transition point to a fully data-driven compliance regime.

Camuso CPA’s Position Since 2016

We anticipated the structural shift long before 1099-DA existed. The compliance infrastructure the IRS needed was imminent. Now, with:

- wallet-level accounting,

- Specific ID enforcement,

- UTC timestamp reporting,

- missing broker basis,

- and standardized custodial reporting,

The IRS finally possesses the inputs required for algorithmic enforcement.

1099-DA reveals non-compliance. Welcome to the Compliance Era for Digital Assets.

State-Level Compliance Under 1099-DA: Montana Leads, and States Will Not Follow IRS Rules

The arrival of Form 1099-DA does not create a unified national reporting system.

It creates two compliance regimes:

- Federal IRS reporting

- Independent state-level reporting frameworks, each with their own rules, thresholds, and enforcement mechanisms.

Montana: First State to Require 1099-DA Filing

In February 2025, Montana became the first state to formally require brokers filing Form 1099-DA with the IRS to also file those forms directly with the State of Montana for 2025 activities.

States Will Use 1099-DA to Expand Their Own Enforcement

Even though 1099-DA is a federal form, states will use its data to:

- match crypto gains to state returns

- issue missing-return notices

- verify part-year residency claims

- audit high-income crypto taxpayers

- enforce underpayment penalties

- track business withholding obligations

What Camuso CPA Recommends Right Now

For investors, founders, funds, and crypto businesses:

- Treat 1099-DA as a dual-layer system

- Maintain independent wallet-level documentation

- Prepare for inconsistent state thresholds and filing deadlines.

- Track residency carefully, especially if moving between high- and low-tax jurisdictions.

- Monitor state-level guidance monthly, not annually.

Camuso CPA’s advisory practice is already integrating state-level 1099-DA reconciliation into our wallet-level accounting and digital asset compliance reviews. The 1099-DA is not merely a federal requirement. It is also the foundation of a new state-federal enforcement architecture.

Montana is first. Others will follow. And none of them are bound to IRS relief, rules, or interpretations.

Taxpayers and brokers must prepare for a fragmented, multi-jurisdiction reporting environment where:

- federal compliance is necessary but not sufficient, and

- state-level crypto enforcement expands rapidly.

What To Do Now: Tax Planning Before 1099-DA Hits Your Mailbox

Form 1099-DA will not simplify digital asset tax compliance but it will expose every inconsistency between what you report and what brokers report. The taxpayers who suffer the most in 2026 will be the ones who wait until forms arrive. The taxpayers who avoid notices, penalties, and reconstructions will be the ones who prepare now, before 1099-DA goes live.

The actions below are the highest-leverage steps for investors, founders and start-ups preparing for the shift to mandatory wallet-by-wallet accounting, Specific Identification compliance, UTC-based reporting, and broker-data mismatches.

Reconstruct Legacy Cost Basis (2014–2024)

Brokers won’t provide basis for pre-2026 assets or anything moved off-platform.

Reconstruction is essential if you have:

- missing exchange data

- commingled wallets

- DEX activity

- NFT mints or LP tokens without basis

- multi-wallet migrations

This is the foundation of audit readiness.

Document Your Transition Under Rev. Proc. 2024-28

You must shift from the universal method to wallet-by-wallet accounting, even if you missed the safe harbor.

This requires:

- a documented transition

- wallet-segmented books

- permanent basis records by wallet

Failing to document the transition increases audit risk.

Re-Engineer Wallet & Account Architecture

Under wallet-by-wallet rules, where you hold a token matters.

Actions to take:

- separate long-term vs. short-term positions

- group high-basis lots intentionally

- ensure Specific ID is feasible in each wallet, as applicable

- align wallets with state residency considerations

This is now a tax-planning process, not just bookkeeping.

Separate Personal and Business Wallets

Mixed-purpose wallets are the fastest path to IRS challenges, especially for founders, operators, and multi-entity structures.

You need:

- clean entity segregation

- treasury vs. personal boundaries

- dedicated business wallets for DAO/protocol activity

Prepare for UTC vs. Local-Time Mismatches

Brokers report using UTC. You report using local time. This creates year-end discrepancies and classification errors.

You must track:

- broker UTC timestamps

- your local-time tax timestamps

This dual-tracking will be essential for reconciliation.

Conduct a Pre-1099-DA Compliance Audit

Before IRS matching begins, identify and fix:

- missing basis

- mis-segmented wallets

- DEX/DeFi/NFT gaps

- staking/lending/LP misclassification

- state-level exposure

- historical inconsistencies

A pre-1099-DA audit removes future CP2000 surprises.

Set Up Standing Orders for Specific Identification

Where supported, configure standing instructions to ensure Specific ID occurs before execution which is required for HIFO, LIFO, or optimized tax-lot strategies. Most taxpayers and CPAs will fail this requirement. 1099-DA will not fix your records. It will expose them. Taxpayers who prepare now with wallet segmentation, basis reconstruction, Specific ID readiness, and timestamp alignment will be the ones who avoid notices and audits in 2026 and beyond.

Coinbase, Cost Basis, and the Pre–1099-DA Correction Window

Recent updates to Coinbase’s tax infrastructure highlight how quickly crypto tax compliance standards are hardening ahead of Form 1099-DA. Coinbase has confirmed that it will support 1099-DA reporting beginning with 2025 activity, alongside user-selected cost basis methods (FIFO, LIFO, HIFO) and a one-time historical cost basis submission window for correcting missing data. Bulk basis updates are also being introduced.

When 1099-DA reporting goes live, exchange-reported proceeds and basis data will flow directly into IRS matching systems. At that stage, discrepancies are no longer software issues since they become taxpayer substantiation issues, governed by recordkeeping and reconciliation standards. For many investors, 2025 effectively functions as the final correction window before historical assumptions harden into enforcement-grade reporting.

Further Reading and Expert Commentary

Camuso CPA has produced some of the most referenced analysis in the digital-asset tax field, including policy reviews, technical deep dives, and practitioner-level guidance. For readers who want to understand the full context behind 1099-DA, the transition away from the universal method, and the foundations of modern digital asset complaince, the following resources provide additional depth:

- Podcast with Raj Mukherjee (Former IRS Senior Advisor and CEO of Bodin Advisory)

- Podcast with Miles Fuller (TaxBit, Former IRS Counsel)

- Podcast with Wendy Walker (VP of Regulatory Affairs at Sovos)

- Webinar Entendre on Rev. Proc. 2024-28

- Video: Deep Dive on Cost Basis Reconstruction & Rev. Proc. 2024-28

- Article: Crypto Cost Basis Rules Quietly Changed In 2025 with Rev. Proc. 2024-28

- Article: I Already Filed My Crypto Taxes: Why 1099-DA Still Puts You at Risk

- Article: Form 1099-DA and the Risk of Undocumented Early-Year Crypto Activity

- Article: I Received a 1099 for Crypto, What Am I Supposed to Do Now?

- Article: The Investor’s Playbook for Surviving the First Wave of Crypto Tax Notices for 1099-DA

- Article: Why Your 1099 Is Missing Crypto Cost Basis and How to Fix It Before IRS Matching Begins

These materials provide the broader analytical foundation behind the guidance in this report and illustrate why Camuso CPA remains the leading authority on digital-asset taxation and reporting.

Frequently Asked Questions for Form 1099-DA

What is IRS Form 1099-DA and when does it start?

Form 1099-DA is the new IRS information return for reporting digital asset sales and exchanges by custodial brokers. It applies to transactions occurring on or after January 1, 2025, with forms first furnished during the 2026 filing season. It replaces the outdated 1099-B framework for crypto but does not provide full gain/loss reporting in its initial years.

Will Form 1099-DA calculate my crypto gains for me?

No. 1099-DA does not calculate gains. For 2025, brokers report proceeds only, not basis. Any assets moved between exchanges, wallets, DEXs, or chains will have missing or unusable basis, and the taxpayer must reconstruct cost basis independently. Relying on 1099-DA alone will lead to mismatches and CP2000 notices.

What is changing with the universal method and wallet-by-wallet accounting?

The IRS has eliminated the “universal method” you can no longer treat all wallets and accounts as a single basis pool. Beginning in 2025, basis and tax-lot selection must be applied wallet-by-wallet (or account-by-account). Each wallet becomes its own cost-basis ledger and lots cannot be mixed across wallets.

How does Rev. Proc. 2024-28 affect cost basis reporting?

Rev. Proc. 2024-28 provided a one-time transition safe harbor for moving from the universal method to wallet-by-wallet accounting. That window has closed for most taxpayers. Even without the safe harbor, all taxpayers must now transition to wallet-level basis tracking, document the transition, and correct historical basis gaps to align with future 1099-DA reporting.

Which tax-lot methods are allowed now: FIFO, Specific ID, HIFO, LIFO?

Only FIFO and Specific Identification are permitted.

HIFO, LIFO, or algorithmic “optimized” methods are allowed only when they operate as valid Specific Identification which requires identifying the exact units before the disposal and documenting the identification for the specific wallet or account. Retroactive software-based lot selection is no longer valid.

Why will most 1099-DA forms be missing cost basis or show incorrect gains?

Most 1099-DAs will be incomplete because:

- Basis reporting is not required for 2025.

- Brokers can only calculate basis for assets they held continuously.

- Transfers, bridges, staking, DeFi, or prior exchange activity break the chain of custody.This means taxpayers will receive 1099-DAs with proceeds but no basis, forcing independent basis reconstruction.

Why Is My 1099-DA Inaccurate?

Form 1099-DA frequently appears “wrong” because brokers report only what they can see within their own custodial system. Transfers, bridges, staking, lending, wrapping, DEX activity, and off-platform history break the broker’s chain of custody. The IRS also allows brokers to furnish forms up to 12 months late, use UTC timestamps, and omit several categories of digital asset transactions entirely. The form reflects the broker’s limited visibility, not the complete tax picture, and taxpayers must reconcile the gaps independently.

Why Is My 1099-DA Missing Cost Basis Information?

Most 1099-DAs will show blank or incomplete cost-basis fields because:

- Basis reporting is not required for any 2025 transactions.

- Brokers can report basis only for assets they held continuously from acquisition to sale.

- Assets acquired before January 1, 2026 are considered noncovered and are exempt from mandatory basis reporting.

- Transfers between platforms break basis lineage until transfer statements become mandatory in later years.

This means your 1099-DA will almost always report proceeds without basis and you must compute gains/losses using your own wallet-level records.

Does 1099-DA report DeFi, NFTs, staking, wrapping, or bridging?

No. Under Notice 2024-57, brokers are temporarily exempt from reporting six major categories of transactions including wrapping/unwrapping, LP activity, staking, lending, short sales, and NPCs. These activities remain fully taxable even though they will not appear on 1099-DA.

What is the “good-faith” relief for late 1099-DA forms, and why does it matter?

Under Notice 2024-56, brokers may issue 1099-DAs up to 12 months late without penalties. This means taxpayers may file returns in April 2026 and receive additional 1099-DAs in late 2026 or early 2027. Late forms create mismatches, triggering CP2000 notices unless taxpayers can reconcile the discrepancies with independent records.

Why does UTC reporting cause mismatches on 1099-DA?

Brokers must report timestamps in UTC, while taxpayers report using their local time zone. A December 31 transaction in EST may appear as a January 1 transaction in UTC. This difference can push disposals into a different tax year on the 1099-DA, generating IRS mismatch flags unless you maintain dual timestamp records.

How should investors, founders, funds, and Web3 businesses prepare for 1099-DA?

You should:

- Reconstruct cost basis for 2013–2024 activity.

- Document your transition to wallet-by-wallet accounting under Rev. Proc. 2024-28.

- Re-architect wallets for FIFO/Spec ID compliance.

- Separate personal and business wallets.

- Track dual timestamps (UTC + local).

- Conduct a pre-1099-DA compliance audit to eliminate gaps before IRS matching begins.

TL;DR: The 1099-DA Digital Asset Compliance Era Has Begun

The IRS’s new Form 1099-DA is the most significant transformation in digital asset tax reporting to date. Beginning in 2025, custodial brokers must report digital asset disposals directly to the IRS, ending the era of fragmented records and ushering in a reporting system designed for automated mismatch detection.

The universal method is eliminated. Wallet-by-wallet accounting is now mandatory. FIFO and pre-disposition Specific Identification are the only permitted lot-selection methods, and Rev. Proc. 2024-28 creates a one-time transition framework that most taxpayers have already missed.

Brokers will report proceeds, but they will not reliably report cost basis, especially for assets acquired before 2026 or moved off-platform. Large categories of taxable DeFi, NFT, staking, and liquidity events remain outside the reporting perimeter, while Notices 2024-56, 2024-57, and 2025-7 introduce temporary relief and exceptions that leave taxpayers responsible for the gaps. Brokers will furnish forms using UTC, not local time, creating systemic timing mismatches at year-end. Transitional relief allows brokers to issue 1099-DAs up to 12 months late, exposing taxpayers to CP2000 notices unless they maintain independent records.

States are beginning to assert their own 1099-DA rules, Montana is the first and state reporting will diverge from IRS guidance, thresholds, and deadlines. The IRS now has the data pipeline it lacked with proceeds-level reporting, wallet clustering, transfer-pattern analytics, and cross-chain heuristics. This is the beginning of the Compliance Era for digital assets. To avoid mismatches, penalties, and reconstructions in 2026 and beyond, taxpayers must prepare now and reconstruct legacy basis, segment wallets, document transition under Rev. Proc. 2024-28, establish Specific ID standing orders, and build audit-ready books that align with the IRS’s reporting architecture.

Preorder the Crypto Tax Handbook™

The Professional Benchmark for Digital Asset Taxation & Accounting.The Crypto Tax Handbook™ sets the professional benchmark for navigating taxation, accounting, and compliance in the digital asset era.

It translates evolving IRS guidance, enforcement priorities, and accounting standards into a clear, actionable framework for investors, founders, and professionals at the frontier of digital finance.

About Camuso CPA

Camuso CPA is the category leader in digital asset taxation, Web3 accounting, and crypto compliance strategy. Since 2016, the firm has advised founders, investors, protocols, start-ups and family offices navigating the technical, regulatory, and operational complexities of digital assets.

Industry Leadership and Credentials

- Forbes Best-In-State Top CPA 2025

- Featured in Accounting Today for a software-agnostic Web3 accounting methodology

- First U.S. CPA firm to accept cryptocurrency payments

- Digital-asset native CPA firm since 2016

- Trusted by DeFi protocols, Web3 startups, miners, validators, and high-net-worth crypto investors

- National speakers and advisors on digital asset tax policy and Web3 accounting systems

- Authors of The Crypto Tax Handook and Navigating the NFT Sales Tax Maze books

- AI-enabled infrastructure for real-time insight, audit-ready documentation, and advanced tax strategy

Camuso CPA is built to lead the new compliance era of digital assets, where proper methodology, evidentiary documentation, and rigorous interpretation drive compliant and reliable tax results.

Prepare now for the transition to 1099-DA. Partner with Camuso CPA for audit-ready compliance, follow our newsletter for continuous analysis, subscribe to our podcast The Financial Frontier for expert commentary and preorder the Crypto Tax Handbook to equip yourself with the most current standards.