Section 1256 and Prediction Markets: Do Kalshi and Event Contracts Qualify?

Prediction markets now operate within formal regulatory infrastructure and, in certain instances, under direct CFTC […]

Prediction markets now operate within formal regulatory infrastructure and, in certain instances, under direct CFTC […]

This article is written for three overlapping audiences who are now being pulled into the […]

Kalshi is no longer an experimental corner of the internet. It is the first CFTC-regulated […]

Prediction markets are no longer a niche experiment. They now sit at the intersection of […]

Digital asset markets have transitioned from a period of limited reporting visibility to one characterized […]

For many digital-asset investors, the prevailing assumption is simple: “I filed every year. I’m done […]

Form 1099-DA introduces standardized, third-party reporting for digital-asset dispositions at scale. That reporting gives the […]

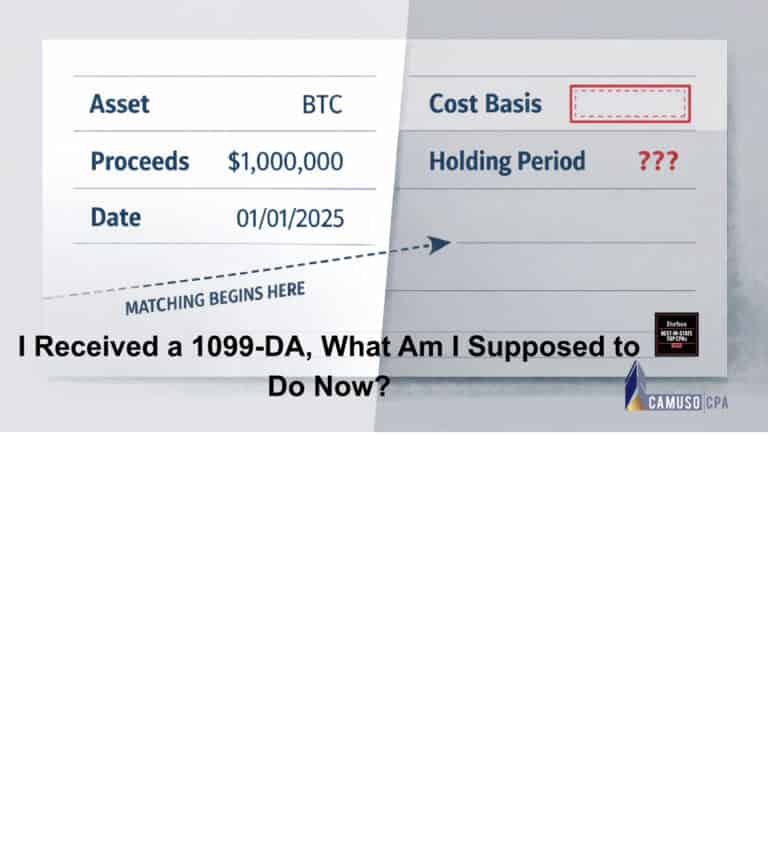

What This Form Means (and What It Doesn’t) Receiving Form 1099-DA is not, by itself, […]

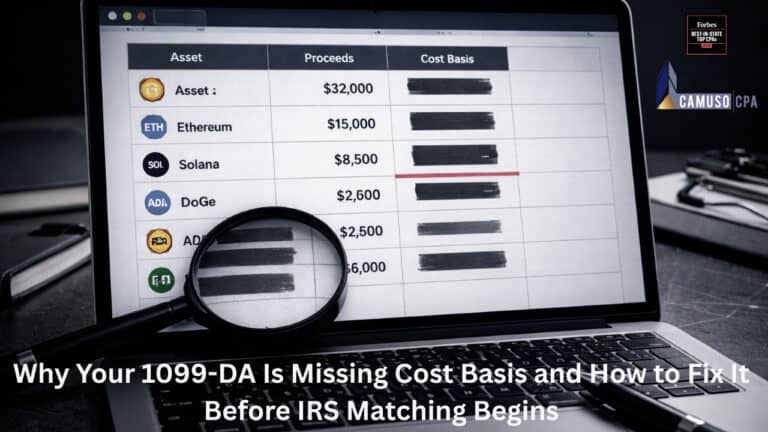

The First Wave of 1099-DA Enforcement Will Operate Through Information-Return Matching For most digital-asset investors, […]

Form 1099-DA is not a convenience tool, it is a visibility mechanism. Its primary purpose […]