Last Updated on November 3, 2025 by Patrick Camuso, CPA

The IRS Is Watching: Form 8949 and the 1099-DA Shift

As the 2025 tax season approaches, U.S. crypto investors face a turning point in digital asset reporting. One overlooked form, IRS Form 8949, is poised to become the silent trigger for thousands of audits. Combined with the rollout of the new Form 1099-DA, this change will transform how the IRS monitors and matches crypto activity.

For years, many investors have filed Form 8949 with minimal IRS oversight. That era is ending. Beginning with the 2025 tax season, digital asset brokers, exchanges, and certain payment platforms are required to issue Form 1099-DA to both investors and the IRS. This form will contain detailed transaction-level data for each trade, sale, or disposal. If your self-reported activity on Form 8949 does not align with what the IRS receives from exchanges, the mismatch could automatically trigger an audit notice or compliance inquiry.

The implications are clear: Form 8949 and Form 1099-DA must tell the same story. And under new accounting rules, that is not as simple as exporting a CSV from your favorite platform.

Why Form 8949 Matters More Than Ever

Form 8949 has always been the backbone of crypto capital gains reporting. It is where investors document every taxable disposal, whether selling, swapping, or using crypto for purchases. Paired with Schedule D, Form 8949 reconciles all realized gains and losses across the tax year. Historically, the IRS had limited visibility into the source data behind these filings. That gap is closing fast.

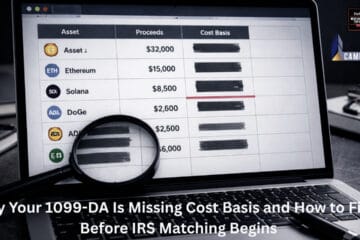

The 1099-DA framework introduces a third-party reporting requirement similar to traditional brokerage accounts. Exchanges will send the IRS precise transaction data, including asset type, acquisition date, cost basis, and sale proceeds. Any inconsistency between your Form 8949 and these official records could lead to data-matching discrepancies, which the IRS flags automatically.

In other words, 2025 will mark the first year when crypto data matching becomes institutionalized. Investors who fail to adapt their accounting and reconciliation processes risk being flagged even if they acted in good faith.

The Evolution of Crypto Reporting: Revenue Procedure 2024-28

Another critical development is Revenue Procedure 2024-28, which eliminated the universal pooling method many investors previously used. Under this guidance, crypto cost basis must now be tracked by account and wallet, not as a global average across platforms. This shift toward account-based accounting has profound implications.

If you continue to pool assets across exchanges, your cost basis calculations will not align with what Form 1099-DA reports. The result? Misstated gains, duplicate entries, or underreported income, all red flags for the IRS’s new reconciliation systems.

Patrick Camuso, CPA, emphasizes that compliance with Revenue Procedure 2024-28 is not optional:

“These are two ticking time bombs: Form 1099-DA and Revenue Procedure 2024-28. If you haven’t adopted account-based accounting, you’re already behind.” Patrick Camuso, CPA

Understanding the Forms That Matter for Crypto Taxes

Here’s how the key IRS forms interact in 2025:

- Form 8949: Reports capital gains and losses for crypto disposals (sales, swaps, or payments).

- Schedule D: Summarizes your capital gains and losses across all investments, pulling data from Form 8949.

- Schedule 1: Captures other income from crypto, such as airdrops, staking rewards, or forks, that is not related to a business.

- Schedule C: Reports income from crypto activities that qualify as business operations or self-employment.

- Form 1099-DA: Provided by brokers and exchanges, it details your crypto transactions for both you and the IRS.

Each form serves a unique function, but alignment is key. Inconsistencies between your Form 8949 entries and the 1099-DA data will create compliance friction. That is why reconciliation, tying your accounting records directly to IRS-reported data, is now the most important step in crypto tax preparation.

Common Mistakes That Trigger IRS Attention

Even experienced investors can make simple mistakes that draw scrutiny. Here are five of the most common:

- Relying on outdated pooling methods. The IRS now mandates account-based cost tracking, meaning each wallet and exchange must be treated separately.

- Ignoring 1099-DA reconciliation. If your reported numbers differ from the 1099-DA forms issued by exchanges, expect an IRS notice.

- Mixing personal and business crypto activity. Misclassifying transactions can distort your income reporting on Schedule 1 versus Schedule C.

- Failing to document transfers. While wallet transfers are not taxable, poor recordkeeping can cause confusion during reconciliation.

- Using incomplete data exports. Many exchange reports omit transaction history for delisted assets or older trades, issues that can only be fixed with proper accounting reconstruction.

How to Prepare for the 2025 Tax Season

Compliance this year requires more than accurate numbers. It requires a structured, defensible accounting system. Here’s how to prepare:

- Rebuild Your Cost Basis.

Reconstruct your historical cost basis for each wallet and exchange account. Missing cost data is the number one reason filings fail reconciliation tests. - Implement Account-Based Accounting.

Segment your accounting by wallet, platform, and asset type. This ensures your internal records align with the new IRS data standards. - Integrate 1099-DA Data Early.

Once brokers issue 1099-DAs, cross-check them against your transaction reports. Correct discrepancies before filing to prevent mismatch notices. - Review Revenue Procedure 2024-28 Compliance.

If your system still uses universal pooling, update immediately. The procedure mandates account-based reconciliation and prohibits portfolio-level averaging. - Work With a Digital Asset CPA.

Crypto tax reporting now requires technical precision. Working with a firm like Camuso CPA ensures your filings stand up to IRS scrutiny while maximizing available deductions.

How Camuso CPA Protects Investors From the Coming Audit Wave

Camuso CPA has spent years preparing clients for the data-driven era of digital asset taxation. As one of the few firms specializing exclusively in crypto accounting and compliance,We offer end-to-end solutions to help investors adapt to the 1099-DA era.

Whether you are a high-net-worth investor, founder, or fund operator, the firm can:

- Reconstruct multi-year crypto accounting records to establish accurate cost basis across wallets and exchanges.

- Implement account-based tracking systems that align with Revenue Procedure 2024-28.

- Prepare audit-proof Form 8949 and Schedule D filings that reconcile directly with 1099-DA data.

- Design proactive, multi-year tax strategies to minimize exposure and optimize after-tax performance.

The firm’s process goes beyond compliance. It builds defensibility. Each client engagement includes documentation designed to withstand IRS review, ensuring that every gain, loss, and transaction can be substantiated.

A Note for Founders and Web3 Businesses

For founders, DAOs, and businesses transacting in crypto, the 1099-DA rollout has additional implications. Entity structures that handle digital assets must now maintain internal reconciliation processes equivalent to traditional financial institutions. This includes:

- Mapping wallet activity to entity ownership.

- Tracking inter-company transfers to avoid double-reporting.

- Maintaining cost basis records for treasury assets.

Failing to do so can expose your company to audit risks that extend to both the business and its officers. Camuso CPA helps businesses implement crypto-native accounting frameworks that satisfy both IRS and GAAP requirements.

Final Thoughts: Preparation Is Protection

The crypto tax environment is evolving rapidly. The 2025 tax season represents the first true test of the IRS’s new enforcement architecture. Between Form 8949, Form 1099-DA, and Revenue Procedure 2024-28, the days of casual crypto reporting are over.

Investors who modernize their accounting now will not only avoid penalties but also unlock new opportunities for tax efficiency and long-term planning. Those who wait until filing season may find themselves scrambling to reconcile inconsistent data under audit pressure.

If you are unsure where to start, remember: preparation is protection. A proactive cleanup today is far less costly than an audit tomorrow.

About Camuso CPA

Camuso CPA is a Forbes Best-in-State digital asset accounting firm serving high-net-worth investors, founders, and businesses navigating complex crypto tax and accounting challenges. Led by Patrick Camuso, CPA, the firm specializes in:

- Crypto accounting reconstruction and audit defense

- Multi-year portfolio optimization and tax strategy

- Compliance with Revenue Procedure 2024-28 and the new 1099-DA framework

- Entity structuring for Web3 and digital asset operations

Whether you have not reconciled your crypto records in years or need to transition to account-based reporting, Camuso CPA can help. The firm’s process rebuilds your cost basis, integrates new IRS standards, and delivers a defensible, forward-looking tax plan tailored to your portfolio.

Visit CamusoCPA.com to schedule a private consultation with Patrick Camuso, CPA. Get your accounting in order before the IRS does and stay ahead of the 2025 compliance curve.