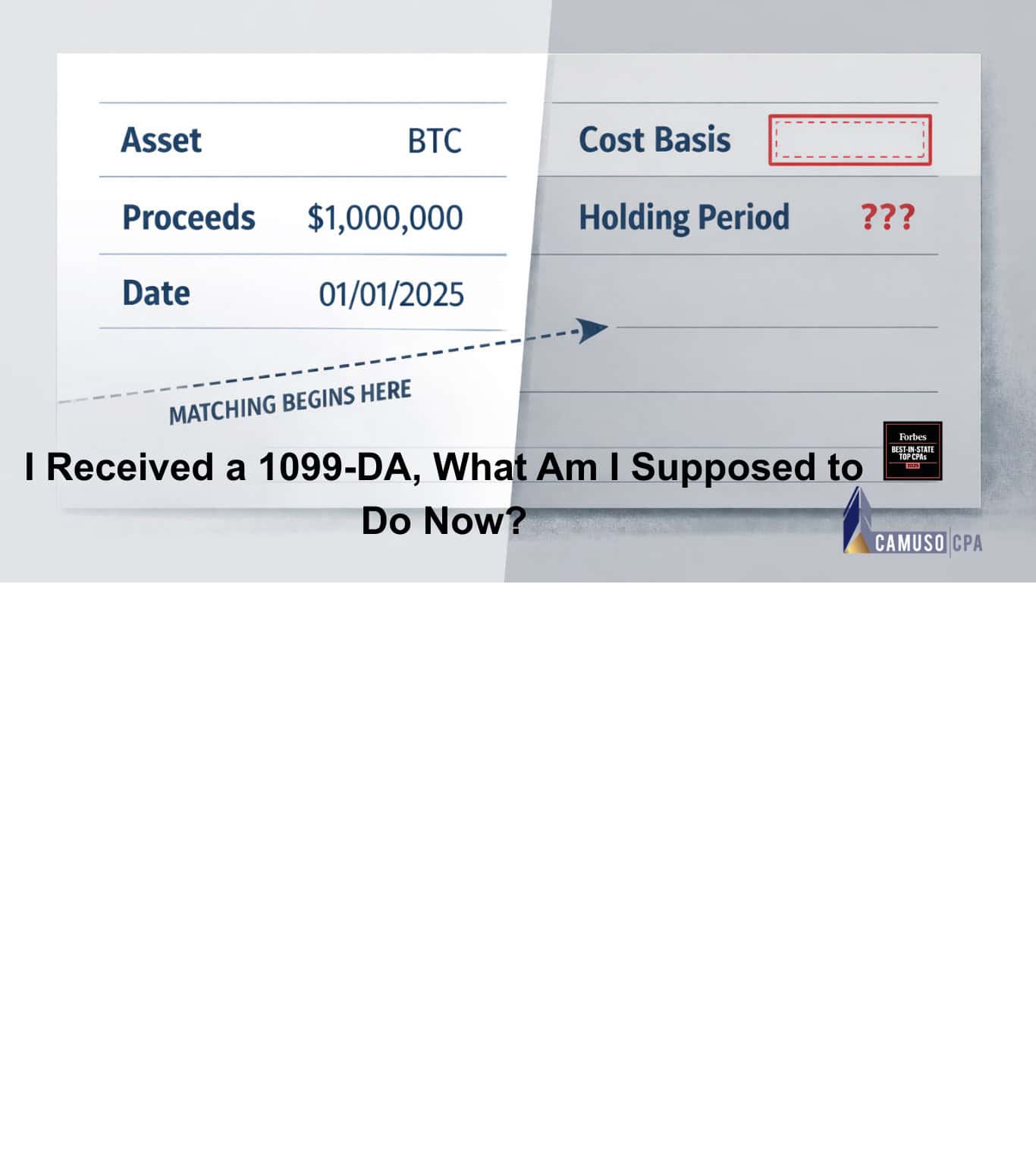

Last Updated on February 14, 2026 by Patrick Camuso, CPA

What This Form Means (and What It Doesn’t)

Receiving Form 1099-DA is not, by itself, an allegation, an audit notice, or a determination that your digital-asset tax reporting is incorrect. Form 1099-DA is a third-party information return filed by brokers, not a tax return filed by the taxpayer.

Its function is narrower and more mechanical.

Form 1099-DA places certain broker-reported digital-asset dispositions inside the IRS’s automated information-return matching and analytics systems. It does not calculate tax liability. It does not determine whether gains are taxable, whether losses are allowable, or whether your reporting position is correct.

The form exists to standardize proceeds-level disposition data so the IRS can compare what brokers report with what appears on Forms 8949, Schedule D, and related filings.

When investors receive a 1099-DA, the most common reactions are either alarm (“the IRS thinks I owe tax”) or dismissal (“this form is incomplete and meaningless”). Both reactions are misplaced.

The correct response is controlled, methodical, and grounded in how information returns are actually used. This article explains what Form 1099-DA represents, why it often appears incomplete, how it interacts with your tax return, and what sophisticated investors should do next, before automated matching and enforcement activity begins. This article will help you learn what to do after the moment of “I Received a 1099 for Crypto”.

Why Form 1099-DA Exists

Form 1099-DA exists because Congress extended the broker-reporting regime under IRC §6045 to digital assets as part of the Infrastructure Investment and Jobs Act. Treasury and the IRS were then responsible for implementing that mandate through regulations, including phased effective dates and transition relief.

Form 1099-DA is not a discretionary IRS policy choice and it is not an audit initiative. It is the operational result of digital assets being brought into an existing information-reporting framework designed to support automated compliance and discrepancy detection.

The final regulations include transition relief and staged implementation. As a result, early-year Forms 1099-DA may appear incomplete, inconsistent or misaligned with taxpayer records.

Functionally, Form 1099-DA is:

- A broker-filed information return

- Reporting gross proceeds and disposition details for certain broker-effectuated digital-asset transactions

- Designed to support IRS matching, discrepancy analysis and downstream enforcement workflows

What it is not:

- A complete record of all digital-asset activity

- A determination of taxable income or capital gains

- A substitute for taxpayer basis records

- Proof that a tax return is incorrect

Form 1099-DA generally reflects only broker-effectuated dispositions. It does not capture all digital-asset activity, particularly transactions occurring entirely in self-custody.

For tax year 2025, brokers are generally required to report gross proceeds, even when cost basis is unavailable, incomplete, or legally non-reportable. Basis reporting is generally not required for that year and, in many cases, not possible due to statutory limits under IRC §6045(g) and custody-tracking constraints.

As a result, Form 1099-DA delivers a partial ledger to the IRS. The IRS’s systems treat that data as presumptively reliable for matching purposes, but the taxpayer’s return remains the asserted tax position provided it can be reconciled and substantiated.

Ignoring Form 1099-DA is risky. Treating it as dispositive is equally problematic. The compliance obligation resides in the reconciliation between the two.

What You Should Not Do When You Receive Form 1099-DA

The most consequential errors investors make after receiving Form 1099-DA are procedural and behavioral.

Common missteps include:

- Assuming the form is incorrect and can be ignored

- Waiting for brokers to issue “corrected” basis information that cannot legally be reported

- Relying on tax software outputs without validating underlying data and methodology

- Amending or refiling returns without reconciling broker-reported proceeds

- Conceding proposed tax adjustments simply to resolve uncertainty

Form 1099-DA does not demand blind acceptance or reflexive correction. It creates a reconciliation obligation. Failing to engage with that obligation, either by dismissing the form or over-reacting to it, often increases exposure rather than reducing it.

The appropriate response is to pause, identify what the form actually covers and evaluate how (and whether) those proceeds were reflected on the return. This is why it’s crucual to work with an experienced Crypto CPA.

What Form 1099-DA Does Not Cover (and Why That Matters)

One of the most common and most dangerous misinterpretations of Form 1099-DA is assuming it represents a comprehensive record of a taxpayer’s digital-asset activity. It does not.

Form 1099-DA is limited by design. It reflects only transactions a broker is treated as effecting under the regulations. That scope constraint is not a flaw; it is a statutory and regulatory boundary. Understanding that boundary is essential to interpreting the form correctly and responding appropriately.

Broker-Effectuated Activity Is the Trigger

Form 1099-DA generally reports dispositions where a broker is treated as facilitating or effecting the transaction under IRC §6045 and the final regulations. This typically includes sales, exchanges, or other dispositions executed through a custodial platform or intermediary that meets the broker definition.

What it does not necessarily include:

- Transactions executed entirely in self-custody with no broker treated as effecting the disposition

- Protocol-level activity conducted directly on-chain absent a reporting intermediary

- Certain DeFi interactions where no party meets the broker definition under §6045

- Transfers between wallets or platforms that are not themselves taxable dispositions

These exclusions are not categorical. Whether activity appears on Form 1099-DA depends on who is treated as the broker, not merely the technical medium through which the transaction occurs.

Why This Creates Risk on Both Sides

From an enforcement perspective, the IRS’s matching systems operate on what they can see. Broker-reported proceeds provide an anchor point for discrepancy detection, not a ceiling on what the IRS may test or examine.

From a taxpayer perspective, this creates two distinct risks:

- False negatives: Activity not reflected on Form 1099-DA may still be reportable. The absence of a form does not eliminate a reporting obligation.

- False positives: Broker-reported proceeds may reflect transactions that were already properly reported, offset by basis, losses, or other adjustments not visible on the face of the form.

Both errors stem from the same misunderstanding, equating Form 1099-DA with completeness.

Why “My 1099-DA Doesn’t Match My Records” Is the Wrong Question

When investors say their Form 1099-DA “doesn’t match” their records, the issue is often not accuracy but scope.

The correct questions are:

- Which dispositions does this broker report?

- Which of those dispositions appear on my return?

- How were basis, holding period and character determined for those items?

- Are there offsets, exclusions, or adjustments that reconcile the difference?

Form 1099-DA is a starting point for reconciliation, not an endpoint for analysis.

Treating Form 1099-DA as incomplete does not excuse inaction. Treating it as complete invites error.

Sophisticated compliance requires recognizing that:

- Form 1099-DA is narrow by design

- The IRS’s systems will test what is reported against what is filed

- The taxpayer’s obligation is to reconcile the two with defensible documentation

Failing to understand what the form does not cover is one of the fastest ways to mis-handle what it does cover.

Why Cost Basis Is Often Missing (and Why Brokers Cannot “Fix It”)

When investors see missing cost basis on Form 1099-DA, the instinct is to assume an error that can be corrected. In most cases, that assumption is wrong.

Cost basis is often absent because the digital asset is treated as noncovered for broker reporting purposes under IRC §6045(g). This is not a data-quality issue. It is a legal and structural limitation.

Under the covered-asset framework, brokers generally may report basis only for assets they tracked continuously from acquisition through disposition within the same account. Once custody lineage breaks through withdrawals, transfers, bridging, wrapping, or assets acquired before basis reporting applied and not tracked from acquisition the asset is generally treated as noncovered for broker basis reporting purposes.

At that point, §6045(g) does not require and in practice does not permit brokers to report basis they did not track as covered assets, even if the taxpayer later provides documentation.

This is why brokers cannot “fix” missing basis by issuing corrected forms. Amended Forms 1099-DA can correct factual errors in proceeds or identifiers, but they cannot reconstruct historical basis the broker never tracked and is not permitted to report.

Two implications follow:

- Missing basis usually reflects statutory limits, not broker failure

- Waiting for corrected forms is rarely a viable compliance strategy

For tax year 2025, this outcome is common. Brokers are generally required to report gross proceeds, while basis reporting is generally not required and often not possible.

The compliance obligation does not disappear when basis is missing. It shifts to the taxpayer. When basis is not reported by the broker, the taxpayer remains responsible for determining, reconciling, and reporting the correct gain or loss on the return, typically on Form 8949 and Schedule D, using substantiated cost basis and holding period information.

Form 1099-DA supplies proceeds data for matching purposes but Form 8949 is where basis is asserted, reconciled, and adjusted. The absence of broker-reported basis does not eliminate the reporting requirement.

Reconcile Reported Proceeds to Actual Accounting

A Form 1099-DA reconciliation is not a plug-and-play exercise. It is the process of demonstrating that broker-reported proceeds correspond to specific dispositions reflected on the tax return, in the correct tax year, with defensible classification and support.

At a minimum, reconciliation requires matching each broker-reported proceeds line to the underlying disposition across three evidentiary layers:

- Broker and exchange records (trade confirmations, fills, withdrawals, deposits, and internal transfers)

- Wallet activity (self-custody movements, consolidations, and wallet migrations that sever acquisition tracking within a broker’s systems)

- On-chain data (transaction hashes, token movements, contract interactions, bridge and wrap events)

Once reported proceeds are tied to the actual economic disposition, the analysis shifts to identifying mismatch drivers that commonly trigger notices:

- Duplicate reporting across brokers, particularly where assets moved between platforms or multiple intermediaries report activity tied to the same economic event

- Fee treatment inconsistencies, where fees are embedded in proceeds, separately stated, netted, or reflected differently across systems, altering amount realized and gain or loss presentation

- Timing mismatches, where standardized time conventions,generally UTC, do not align with local timestamps, shifting dispositions across tax years near year-end

- Certain reportable events as defined under the broker regulations, which may be presented in a manner that does not map cleanly to legacy taxpayer records and therefore require classification review rather than mechanical import

The objective is to produce a transaction schedule that is internally consistent, reconciles to third-party proceeds and can be substantiated on Form 8949 and Schedule D if questioned.

Skipping reconciliation and proceeding directly to reporting effectively assumes that the IRS’s matching logic will interpret your return the same way your software does. That assumption materially increases enforcement risk.

Reconstruct and Allocate Cost Basis Where Required

When Form 1099-DA reports proceeds without basis, the obligation shifts to the taxpayer.

Under IRC §6001 and the broker reporting regulations, basis must be substantiated when it is not reported as covered. Cost basis reconstruction is generally required when assets were acquired outside the broker’s reporting regime or when custody lineage was broken through transfers, bridging, wrapping, or wallet migrations that severed acquisition tracking.

Because Form 1099-DA reports account-level proceeds, accounting and cost basis tracking must align to that structure. Universal pooling across wallets or platforms often fails to reconcile against broker-reported dispositions.

Rev. Proc. 2024-28 provides limited transition rules from universal to account basis but does not eliminate the need for reconstruction or allocation discipline. Defensible accounting requires unit- or account-level basis schedules that align with Form 8949 reporting and a consistently applied lot-selection methodology.

Reconciling Form 1099-DA on Form 8949 and Schedule D

Form 1099-DA does not replace the tax return. The return remains the taxpayer’s asserted tax position. Third-party reporting must be reconciled to that position, not ignored and not blindly accepted. This is particularly important where broker-reported data is incomplete, partial, or misaligned with the taxpayer’s records.

Under IRC §6001, the burden of substantiation rests with the taxpayer, even when information returns do not reflect full transactional context or basis history.

In practice, reconciliation occurs through Form 8949 and Schedule D, where broker-reported proceeds are matched to specific dispositions and adjusted for substantiated basis, holding period, and characterization.

Aggregation may be used only where IRS-permitted formats and requirements are satisfied. When those conditions are not met, line-item reporting is generally required to preserve defensibility and audit clarity.

The objective is internal consistency. The return must clearly demonstrate how broker-reported proceeds were incorporated, adjusted, or excluded, supported by records capable of withstanding automated matching and downstream review.

What Happens If You Do Nothing

Form 1099-DA does not require immediate action, but it does initiate a process.

Information returns are ingested into IRS systems as they are received and validated. Matching against filed returns occurs as that data is processed, not at a single fixed point in time. Where discrepancies are identified, enforcement does not begin with investigation, it begins with automated discrepancy analysis.

In most cases, taxpayers will not hear anything immediately. Notices typically arrive months later, after matching cycles are completed and proposed adjustments are generated.

Critically, missing basis does not delay enforcement. Proceeds alone are sufficient to trigger discrepancy analysis and notice issuance. When basis is absent or unsubstantiated, the enforcement posture does not pause simply because basis is absent. The burden shifts, to the taxpayer to reconcile, explain, and substantiate the reported position.

Doing nothing does not keep a file dormant. It allows the system to proceed without context, increasing the likelihood that the first substantive interaction occurs through a proposed adjustment rather than a controlled response.

Steps For Investors & Founders That Receive Form 1099-DA

The appropriate response depends on the condition of the taxpayer’s records and the complexity of the underlying activity.

If basis is complete and traceable

Broker-reported proceeds should be reconciled to Forms 8949 and Schedule D. Lot selection, holding period classification and fee treatment must align with the asserted reporting position.

If basis is incomplete or fragmented

Basis must be reconstructed and allocated before filing or responding to any notice. Proceeds-level reconciliation alone does not resolve exposure.

If activity spans multiple tax years or includes legacy acquisitions

The issue should be evaluated holistically and basis reconstructed from the beginning of historical activity. Partial corrections often create inconsistencies across years that surface during matching or correspondence review.

If activity involves DeFi, bridging, or mixed custody

Standard reconciliation frameworks frequently break down. These fact patterns raise reporting, characterization, and substantiation questions that cannot be resolved mechanically. Each path should result in a position that can be reconciled to third-party reporting, substantiated under IRC §6001, and sustained if reviewed.

Digital Asset Compliance Era

This marks what we call at Camuso CPA the start of the Digital Asset Compliance Era. Digital assets are no longer evaluated in isolation or on a self-reported basis alone. They are now examined through standardized third-party data, automated matching and cross-system corroboration.

For investors and founders, this shifts the burden from explanation after the fact to preparation in advance. Compliance readiness now depends on whether records can be reconciled, positions substantiated and methodology defended when discrepancies surface.

Those who prepare for that reality retain control. Those who do not will encounter it through notices, adjustments and enforced reconciliation.

Watch I Received a 1099-DA What Am I Supposed to Do Now

Frequently Asked Questions: Form 1099-DA & Crypto Tax Compliance

What is Form 1099-DA?

Form 1099-DA is a third-party information return filed by brokers to report certain digital-asset dispositions. It is used by the IRS for information-return matching and enforcement workflows. It is not a tax return and does not determine your tax liability.

Does receiving a Form 1099-DA mean I’m being audited?

No. Receiving Form 1099-DA does not mean you are under audit. It means broker-reported proceeds may be compared to what appears on your tax return through automated matching and discrepancy analysis.

Why is cost basis missing on my Form 1099-DA?

Cost basis is often missing because the asset is treated as noncovered for broker reporting purposes under IRC §6045(g). In many cases, brokers are not required and are not permitted to report basis they did not track as covered assets.

Can my broker correct missing cost basis later?

Generally, no. Brokers may correct factual errors in proceeds or identifiers, but they cannot reconstruct or add historical basis that was never tracked and is not reportable under the regulations.

If basis is missing, will the IRS still enforce?

Yes. Gross proceeds alone are sufficient to initiate IRS matching and discrepancy analysis. When basis is missing, enforcement does not stop—it shifts the burden to the taxpayer to substantiate and reconcile the correct gain or loss.

Does Form 1099-DA include all my crypto activity?

No. Form 1099-DA generally reflects only broker-effectuated dispositions. It does not necessarily include self-custody transactions, protocol-level activity, or certain DeFi interactions where no reporting broker is treated as effecting the transaction.

How do I reconcile Form 1099-DA on my tax return?

Reconciliation occurs primarily on Form 8949 and Schedule D. Broker-reported proceeds must be matched to specific dispositions and adjusted for substantiated basis, holding period, and characterization.

Is FIFO mandatory now for crypto taxes?

FIFO operates as the default lot-selection method absent adequate identification. Specific identification may still be used when properly documented and applied consistently before disposition.

Can tax software fix 1099-DA discrepancies automatically?

No. Tax software performs calculations based on inputs but does not create substantiation. The IRS evaluates records, methodology, consistency, and documentation, not software outputs. Learn about our approach to crypto tax software here.

What should I do immediately after receiving a Form 1099-DA?

You should identify what activity the form covers, reconcile reported proceeds to your records, reconstruct basis where required, and ensure your reporting position on Form 8949 and Schedule D is internally consistent and defensible.

Preorder the Crypto Tax Handbook™

The Professional Benchmark for Digital Asset Taxation & Accounting.The Crypto Tax Handbook™ sets the professional benchmark for navigating taxation, accounting, and compliance in the digital asset era.

It translates evolving IRS guidance, enforcement priorities, and accounting standards into a clear, actionable framework for investors, founders, and professionals at the frontier of digital finance.

About Camuso CPA

Camuso CPA is the category leader in digital asset taxation, Web3 accounting, and crypto compliance strategy. Since 2016, the firm has advised founders, investors, protocols, start-ups and family offices navigating the technical, regulatory, and operational complexities of digital assets.

Industry Leadership and Credentials

- Forbes Best-In-State Top CPA 2025

- Featured in Accounting Today for a software-agnostic Web3 accounting methodology

- First U.S. CPA firm to accept cryptocurrency payments

- Digital-asset native CPA firm since 2016

- Pioneer of SegFIFO™, the wallet-level FIFO cost-basis method

- Developer of ChainRecon™, forensic wallet and on-chain reconciliation framework

- Trusted by DeFi protocols, Web3 startups, miners, validators, and high-net-worth crypto investors

- National speakers and advisors on digital asset tax policy and Web3 accounting systems

- Authors of The Crypto Tax Handook and Navigating the NFT Sales Tax Maze books

- AI-enabled infrastructure for real-time insight, audit-ready documentation, and advanced tax strategy

Camuso CPA is built to lead the new compliance era of digital assets, where proper methodology, evidentiary documentation, and rigorous interpretation drive compliant and reliable tax results.

Prepare now for the transition to 1099-DA. Partner with Camuso CPA for audit-ready compliance, follow our newsletter for continuous analysis, subscribe to our podcast The Financial Frontier for expert commentary and preorder the Crypto Tax Handbook to equip yourself with the most current standards.