Last Updated on March 5, 2026 by Patrick Camuso, CPA

Kalshi is no longer an experimental corner of the internet. It is the first CFTC-regulated event-contract exchange operating in the United States, and it now sits at the intersection of trading, macro forecasting, and real capital deployment.

Because Kalshi operates within a formal regulatory framework and because some traders receive tax forms, many assume Kalshi tax reporting is straightforward. It is not.

While Kalshi differs meaningfully from offshore or decentralized prediction markets, its tax reporting still leaves critical analytical gaps. The forms a trader receives do not determine tax character, do not capture full contract-level activity, and do not resolve the unsettled questions surrounding how event-based contracts should be treated under existing U.S. tax law.

This article is Kalshi-specific. It explains:

- What Kalshi actually reports (and what it does not)

- Why tax forms are a starting point, not a conclusion

- How Kalshi event contracts are analyzed under existing law

- Why Section 1256 is often raised and why it remains unsettled

- What defensible reporting looks like in practice

For a broader discussion of prediction markets generally, including capital vs. ordinary treatment debates and why USD settlement does not simplify tax analysis, see our full prediction market tax analysis.

What Makes Kalshi Structurally Different

Kalshi operates as a CFTC-regulated Designated Contract Market (DCM). That regulatory status distinguishes it from:

- On-chain prediction markets like Polymarket

- Offshore event-contract platforms

- Traditional sports betting operators

From a regulatory standpoint, Kalshi contracts are standardized, centrally cleared, and traded on a U.S.-regulated exchange. From a tax standpoint, it matters, but it does not answer the question.

CFTC regulation affects market structure, not automatic tax classification. As we explain in our main analysis, regulatory status introduces analytical considerations but does not provide definitive answers.

What Kalshi Actually Reports (and What It Doesn’t)

One of the most common misconceptions among Kalshi traders is that Kalshi provides complete broker-style tax reporting. It does not.

Forms Kalshi May Issue (Limited and Incomplete)

Based on Kalshi’s public disclosures:

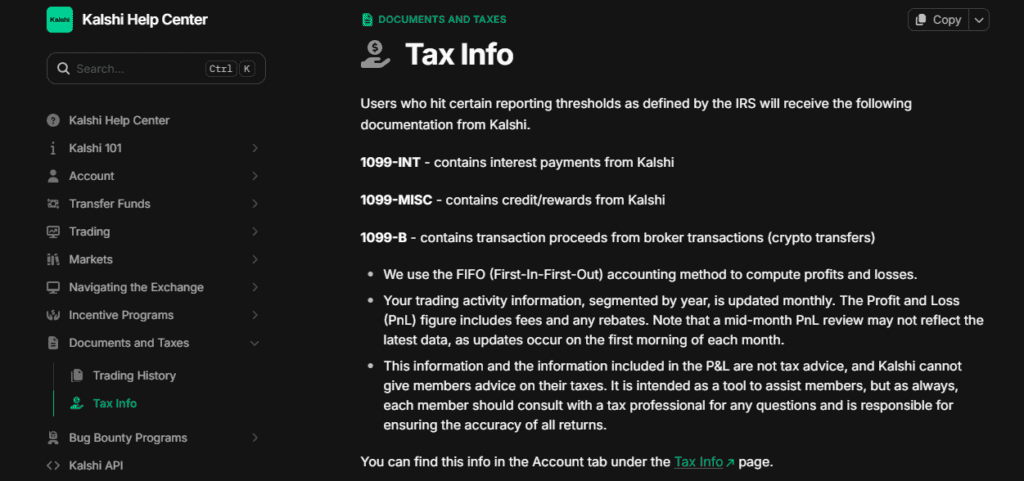

- Form 1099-MISC :May be issued for certain credits or rewards (such as referral bonuses) if they total $600 or more.

- Form 1099-INT: May be issued for interest earned on cash balances if it totals $10 or more.

- Form 1099-B: Currently used only for limited broker-type transactions, not for standard event-contract trading activity.

- Form 1099-DA: Not mentioned by Kalshi.

Kalshi does not currently issue comprehensive 1099-B reporting covering contract-level acquisitions, dispositions, basis, or total annual profit and loss from event contracts.

What This Means for Traders

- The IRS may see some Kalshi-related income

- The IRS does not receive a full contract-level trading picture

- Absence of a comprehensive 1099 does not eliminate reporting obligations

Why Kalshi Tax Treatment Remains Unsettled

Despite Kalshi’s regulated status and the presence of limited tax forms, U.S. tax law does not provide clear guidance on how event-based prediction contracts should be characterized for federal income tax purposes.

The Internal Revenue Code was not drafted with event-based markets in mind. As a result, Kalshi contracts do not map cleanly onto existing categories such as securities, commodities futures, options, or wagering transactions.

This lack of statutory fit creates genuine analytical uncertainty:

- There is no IRS guidance addressing prediction market contracts directly

- Event-based contracts settle on binary outcomes rather than prices, rates, or indices

- Information reporting, where it exists, is incomplete and does not resolve character

- Multiple Code sections may plausibly apply depending on interpretation and facts

In the absence of specific guidance, tax treatment must be determined by applying general tax principles to novel fact patterns. Reasonable professionals can and do disagree on the correct framework.

That disagreement does not mean reporting is optional. It means that consistency, documentation, and risk awareness matter more than optimization.

How Kalshi Event Contracts Are Analyzed Under Existing Law

Step One: Realization Under Section 1001

Kalshi trading generally involves:

- Acquiring a transferable contractual right

- Paying consideration to acquire that right

- Disposing of that right through sale or settlement

- Receiving a determinable amount upon disposition

When a taxpayer acquires a contractual right for consideration and later disposes of it for value, the transaction typically enters realization analysis under Section 1001.

Step Two: Character Analysis Comes After

Once gain or loss is realized under Section 1001, character is analyzed separately. That analysis may occur under:

- Section 1221 (capital asset framework), or

- Ordinary-income principles if an exclusion or alternative statutory regime applies

Collapsing realization and character into a single step is a common mistake.

Kalshi Tax Reporting Frameworks Observed in Practice

In unsettled areas of tax law, the goal is not to find the most favorable outcome, but the most defensible one. Positions should be reasonable, consistently applied, and supported by records that would withstand examination years later. Optimization without guidance increases risk

Ordinary-Income Reporting

Many traders report Kalshi activity as ordinary income, often mirroring limited 1099 reporting.

Pros

- Simple

- Low mismatch risk

- Conservative

Cons

- Potential overpayment

- Minimal analytical documentation

Capital Gain/Loss Reporting

Under this framework, Kalshi contracts are analyzed as transferable contractual rights under Section 1001, with character considered under Section 1221. Whether contracts qualify as capital assets is fact-dependent and subject to interpretation.

Pros

- Standard capital framework

- Full loss netting

Cons

- Requires reconstruction

- Mostly short-term treatment in practice

Section 1256 Treatment

Section 1256 is frequently raised in discussions of Kalshi taxation because the exchange is CFTC-regulated. However, §1256 treatment for event-based prediction contracts is unsettled and should not be viewed as a default or generally advisable position.

The Dollar Impact of §1256 Treatment

For a Kalshi trader with substantial winnings, the difference between frameworks is material.

Example: $100,000 in net Kalshi gains, high-income taxpayer (37% bracket)

| Treatment | Federal Tax Liability |

|---|---|

| Ordinary income | ~$37,000 |

| §1256 (60/40 split)* | ~$26,800 |

*Assumes 60% taxed at 20% LTCG, 40% at 37% ordinary.

The tax benefit is real. The analytical burden is also real. This example illustrates why §1256 is often discussed, not why it should be adopted. Tax benefit alone does not determine defensibility.

What §1256 Reporting Actually Looks Like

The following describes reporting mechanics only and should not be read as an endorsement of §1256 treatment.

If a taxpayer determines §1256 applies:

-

Form 6781

-

Mark-to-market year-end positions

-

Report realized + unrealized gains/losses

-

-

Schedule D

-

Apply 60/40 split

-

Compared to ordinary income (Schedule 1) or standard capital gains (Form 8949), §1256 is significantly more complex.

Reconstruction and Reporting Mechanics

Regardless of whether Kalshi activity is reported as ordinary income, capital gain or loss, or under a specialized statutory regime, accurate reporting requires reliable reconstruction of trading activity.

Information returns, where issued, do not provide a complete transaction-level record of event-contract trading. Platform dashboards summarize outcomes but do not preserve the acquisition, disposition, and timing detail required to substantiate reported amounts.

In practice, defensible reporting requires:

-

Downloading full transaction history from the platform

-

Identifying each contract acquisition and disposition or settlement

-

Reconciling reported amounts to platform records and cash flows

-

Applying the chosen reporting framework consistently

-

Retaining supporting documentation

Ordinary-income reporting may reduce interpretive complexity around character, but it does not eliminate the need to substantiate amounts, timing, or net results. Reconstruction is a compliance requirement, not an elective optimization step.

This is analytical work, not data entry. For traders with significant Kalshi activity, professional guidance on framework selection, reconstruction, and documentation is often warranted.

Common Kalshi Reporting Errors

- Assuming the tax form dictates treatment or reporting

- Claiming §1256 without documentation

- Mixing reporting frameworks

- Ignoring year-end positions

- Relying solely on dashboards

- Reporting contracts as gambling income

When Specialized Analysis Makes Sense

DIY reporting may be sufficient if:

- Dollar amounts are modest

- Ordinary-income treatment is acceptable

- Risk tolerance is low

Specialized analysis is often warranted when:

- Net profits, gains or losses are substantial

- §1256 or capital treatment is considered

- Audit defensibility matters

- Activity spans multiple tax years

At Camuso CPA , we work with Kalshi traders to evaluate whether any alternative framework is supportable, reconstruct contract lifecycles, and prepare tax returns as appropriate. This is interpretive work in an unsettled area of tax law.

Kalshi Tax Reporting FAQ

Does Kalshi issue comprehensive tax forms like a brokerage?

Not comprehensively. Kalshi may issue Form 1099-MISC for certain credits or rewards (such as referral bonuses) and Form 1099-INT for interest on cash balances, but it does not currently provide broker-style reporting for event-contract trading activity. As a result, traders are responsible for reconstructing contract-level gains and losses regardless of whether any tax form is received.

How should Kalshi trading activity generally be reported for U.S. tax purposes?

Because the IRS has not issued prediction-market-specific guidance, traders must apply existing tax principles. In practice, most conservative approaches treat Kalshi contracts as non-equity, cash-settled instruments and report net results as ordinary income. This approach prioritizes consistency, documentation, and audit defensibility in the absence of clear statutory direction.

Can Kalshi contracts qualify for Section 1256 treatment?

Section 1256 treatment is unsettled for event-based prediction contracts and should not be viewed as a default or generally advisable position. While Kalshi’s CFTC regulation is necessary for §1256 consideration, event-based contracts that settle on binary outcomes do not clearly fit within the statute’s traditional scope. Claiming §1256 treatment would require strong factual support, formal analysis, Form 6781 reporting, and a willingness to defend the position under examination. Many taxpayers and advisors do not pursue this approach. For most individual traders, ordinary-income reporting remains the most conservative and commonly adopted approach.

If no tax form is issued, is reporting still required?

Yes. The absence of a 1099 does not eliminate the obligation to report taxable activity. Traders should maintain complete platform transaction histories, settlement records, account statements, and valuation data. These records should be retained for at least seven years and must support whatever reporting framework is used.

Are prediction market profits treated as gambling winnings?

Not by default. While prediction markets involve contingent outcomes, tax characterization depends on transaction structure. Where participants acquire and dispose of transferable contracts with determinable pricing, analysis typically proceeds under contract or property principles rather than gambling rules. Ordinary-income treatment does not imply gambling treatment, and gambling loss limitations do not automatically apply.